SALE AND PURCHASE AGREEMENT

AMONG

GLOBAL CLEAN ENERGY HOLDING, INC.

AND

MDI ONCOLOGY, INC.

AND

CURADIS GMBH

Dated

November 16, 2009

SALE AND ASSET PURCHASE AGREEMENT

This Sale and Asset Purchase Agreement (this “Agreement”, which term is intended to include all exhibits, schedules and other documents attached hereto or referred to herein) is made and entered into as of November 16, 2009 (the “Effective Date”) by and between Global Clean Energy Holdings, Inc., a Utah corporation formerly known as Medical Discoveries, Inc. (“GCEH”), and MDI Oncology, Inc., a Delaware corporation (“MDI” and collectively with GCEH, “Sellers”), whose principal places of business are located 6033 West Century Blvd., Suite 895 Los Angeles, CA 90045, and Curadis GmbH (“Curadis”), whose principal place of business is Henkestr. 91, 91052 Erlangen, Germany. Individually GCEH, MDI and Curadis shall be referred to as a “Party” and collectively as the “Parties.”

RECITALS

GCEH and MDI purchased substantially all of the intellectual property assets of Savetherapeutics AG a German company in liquidation pursuant, to an agreement with its liquidator, dated March 11, 2005 (the “Savetherapeutics Contract”), as a result of which Sellers own, among other things, patents, patent applications, pre-clinical study data and ancillary clinical trial data concerning “SaveCream”, a developmental topical aromatase inhibitor cream (the “Product”).

The Parties have entered into a letter, dated August 25, 2009, regarding the acquisition by Curadis of all of Sellers’ rights under the Savetherapeutics Contract, and all intellectual property and other rights owned by Sellers, whether subsequently acquired or developed by or though the efforts of Sellers or otherwise, which are related to the Product.

NOW, THEREFORE, in consideration of the mutual covenants, agreements, representations and warranties herein, the Parties agree as follows:

ARTICLE 1

DEFINITIONS

For purposes of this Agreement, the following definitions shall apply unless specifically stated otherwise:

1.1 “Affiliate” shall mean, with respect to any Person, any other Person controlling, controlled by or under direct or indirect common control with such Person. A Person shall be deemed to control a corporation (or other entity) if such Person possesses, directly or indirectly, the power to direct or cause the direction of the management and policies of such corporation (or other entity), whether through the ownership of voting securities, by contract or otherwise.

1.2 “Agreement” shall have the meaning set forth in the heading of this document.

1.3 “Assigned Contracts” shall have the meaning set forth in Section 3.2(a) of this Agreement.

1.4 “Australian Patent” shall mean the patent granted to Sellers (Pub. No. AU 751040) in Australia. The Parties acknowledge that the Australian Patent has lapsed and that Curadis has agreed to use its good faith efforts to cause the Australian Patent to be re-instated.

1.5 “Closing” shall have the meaning set forth in Section 4.1(b).

1.6 “Co-Development Contract” shall mean that certain Definitive Master Agreement, dated July 29, 2006, entered into between MDI and Eucodis Forschungs-und Entwicklungs GmbH.

1.7 “Collateral” shall have the meaning set forth in Section 2.5 of this Agreement.

1.8 “Confidential Information” shall have the meaning set forth in Section 8.1 of this Agreement.

1.9 “Covered Product” shall mean (a) the Product, and (b) any other cosmetic, pharmaceutical, diagnostic, therapeutic or other product that cannot be manufactured, used, sold, offered for sale without infringing one or more valid claims under the Patents Rights, whether or not such product is manufactured, used, distributed or sold by Curadis or any of its Affiliate.

1.10 “Curadis” shall have the meaning set forth in the heading of this Agreement.

1.11 “Effective Date” shall have the meaning set forth in the heading of this Agreement.

1.12 “Encumbrance” shall mean any title defect, mortgage, assignment, pledge, hypothecation, security interest, lien, charge, option, claim of others or encumbrance of any kind.

1.13 “First Commercial Sale” shall mean the first sale of any Covered Product.

1.14 “GCEH” shall have the meaning set forth in the heading of this Agreement.

1.15 “MDI” shall have the meaning set forth in the heading of this Agreement.

1.16 “Net Sales” shall means the gross amount received on sales by Curadis or any of its Affiliates and or licensees of Covered Products, less the following: (a) amounts repaid or credited by reason of rejection or return; (b) to the extent separately stated on purchase orders, invoices, or other documents of sale, any taxes or other governmental charges levied on the production, sale, transportation, delivery, or use of a Covered Product which is paid by or on behalf of Curadis, its Affiliates or any licensees; and (c) outbound transportation costs prepaid or allowed and costs of insurance in transit.

In any transfers of Covered Products between Curadis and an Affiliate or a licensee, Net Sales shall be calculated based on the final sale of the Covered Product to an independent third party. In the event that Curadis or an Affiliate or a licensee receives non-monetary consideration for any Covered Products, Net Sales shall be calculated based on the fair market value of such consideration.

In the case of sales of a product that contains a Covered Product component and at least one other essential functional component (“Combination Products”), Net Sales means the gross amount billed or invoiced on sales of the Combination Product.

1.17 “Parties” shall have the meaning set forth in the heading of this Agreement.

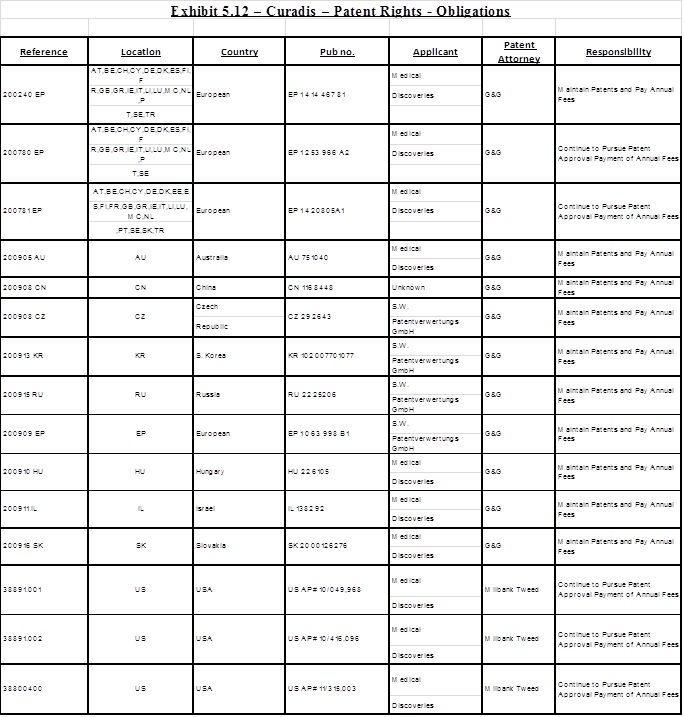

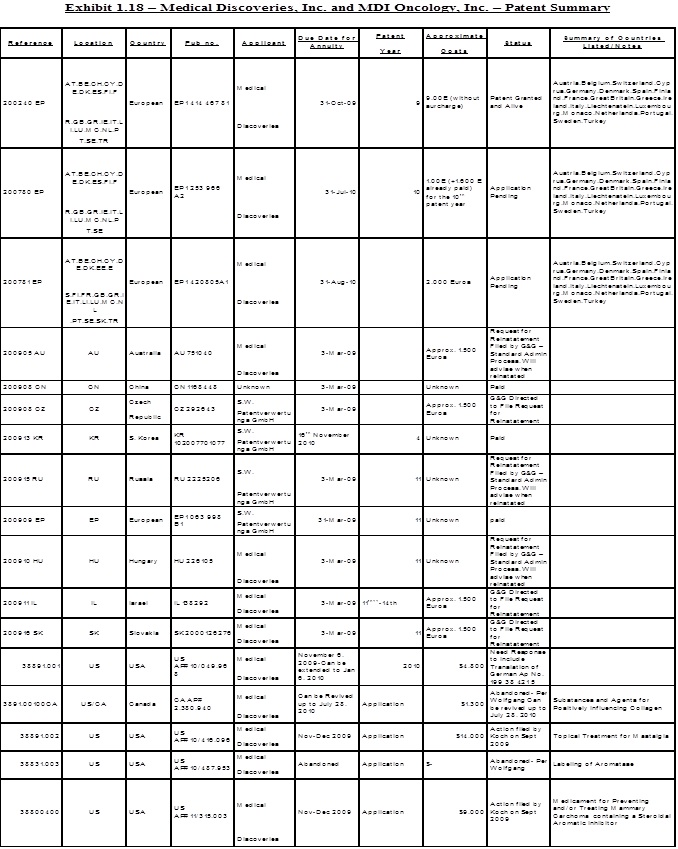

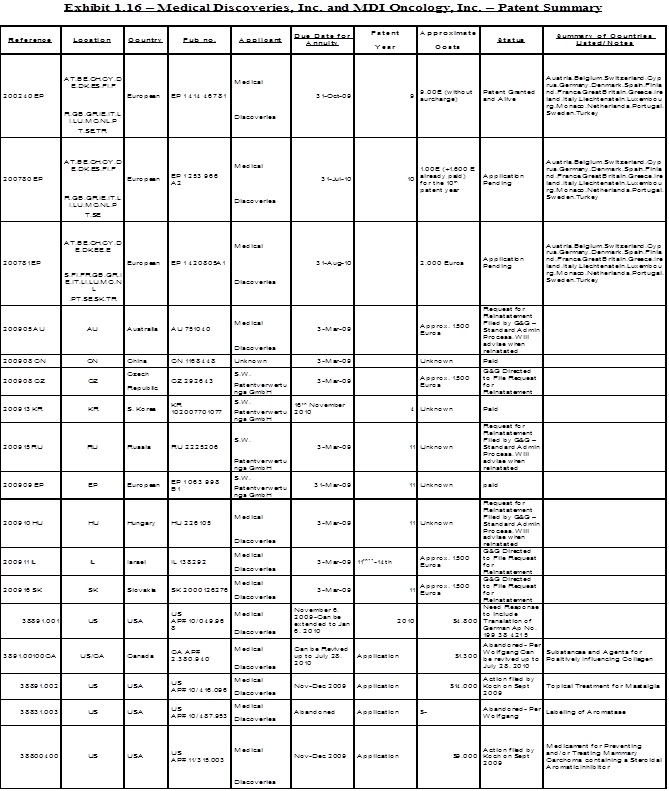

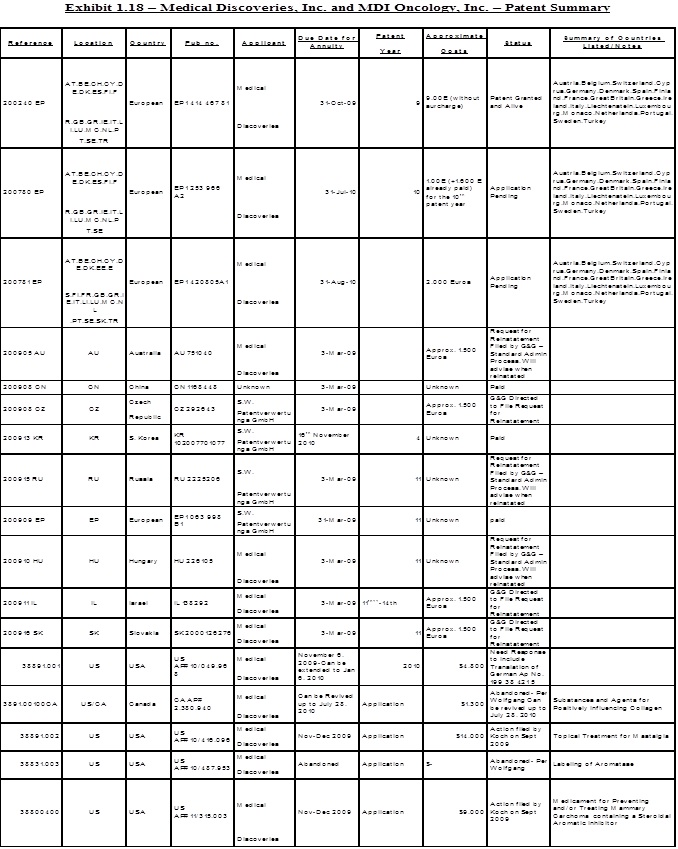

1.18 “Patent Rights” shall mean all of Sellers’ right, title and interest in the patents and patent applications acquired under the Savetherapeutics Contract or in connection therewith, and any other patent and/or patent application listed in Exhibit 1.18 attached hereto, and any division, continuation, continuation-in-part, renewal, extension, reexamination or reissue of each such patent and any and all corresponding U.S. and foreign counterpart patent applications or patents.

1.19 “Product” shall have the meaning set forth in the Recitals to this Agreement.

1.20 “Purchased Assets” shall mean:

(a) All of the intellectual property and all contractual and other rights, if any, acquired by Sellers pursuant to the Savetherapeutics Contract;

(b) All of the intellectual property and all contractual and other rights acquired by Sellers pursuant to the Co-Development Contract;

(c) Any and all Patent Rights, inventions, discoveries, rights in confidential data (including know-how and trade secrets), manufacturing methods and processes, trademarks, trade names, brand names, logos, trade dress, copyrights and other intellectual property and goodwill associated with the Product, owned or under contract to acquire by Sellers, in each case whether registered or unregistered, and including without limitation all applications for and renewals or extensions of such rights, and all similar or equivalent rights or forms of protection;

(d) Any regulatory files and data relating to the Product owned by Sellers, including without limitation marketing authorization procedures and preclinical and clinical studies; and,

(e) All rights of Sellers under the Assigned Contracts.

1.21 “Purchase Price” shall have the meaning set forth in Section 3.1 of this Agreement.

1.22 “Person” shall mean any individual or corporation, partnership, trust, incorporated or unincorporated association, joint venture or other entity of any kind.

1.23 “Russian Patent” shall mean the patent initially granted to SW Patentverwertungs GmbH (Pub. No. RU 2225206) in Russia. The Parties acknowledge that the Russian Patent has lapsed and that Curadis has agreed to use its good faith efforts to cause the Russian Patent to be re-instated.

1.24 “Savetherapeutics Contract” shall mean the agreement with the liquidator of Savetherapeutics AG, a German company in liquidation, dated March 11, 2005, attached to this Agreement as Exhibit 1.24.

1.25 “Schmidt Litigation” shall mean the lawsuit between MDI and Dr. Alfred Schmidt currently pending before a court in Hamburg, Germany.

1.26 “Sellers” shall have the meaning set forth in the heading of this Agreement.

1.27 “Transfer Documents” shall have the meaning set forth in Section 2.5 of this Agreement.

ARTICLE 2

SALE, ASSIGNMENT AND TRANSFER OF PURCHASED ASSETS

2.1 Subject to the terms and conditions set forth in this Agreement and in reliance upon the representations and warranties of the Parties herein set forth, at the Closing Sellers shall sell, assign, transfer, and convey, as the case may be, the Purchased Assets to Curadis, and Curadis shall purchase the Purchased Assets. Title to all of the Purchased Assets shall be delivered to Curadis at the Closing.

2.2 The Purchased Assets shall be sold, assigned, transferred, conveyed and delivered to Curadis free of any and all liabilities, obligations and encumbrances except only for those listed in Exhibit 2.2.

2.3 Upon the Closing, all of the Purchased Assets and all non-publicly available information relating thereto shall be considered to be Confidential Information belonging to Curadis, and the Sellers shall no longer have any rights thereto or therein, except to the extent set forth in the Security Agreement.

2.4 Sellers shall be responsible for all sales, use, transfer, value added and other related taxes, imposed by the United States government, if any, arising out of the sale by Sellers of the Purchased Assets to Curadis pursuant to this Agreement, and Curadis shall be responsible for all other sales, use, transfer, value added and other related taxes arising out of the sale by Sellers of the Purchased Assets to Curadis pursuant to this Agreement.

2.5 Until the Purchase Price (as set forth in 3.1 below) is fully paid, Curadis shall not, without the Sellers’ prior written consent, sell, transfer or convey, as the case may be, the Purchased Assets to a third party, except for licensing in the ordinary course of business, or create or permit to be created an Encumbrance over the Purchased Assets, except for the security interest granted under Section 2.6 of this Agreement and encumerances for taxes, assessments or government charges or claims the payment of which is not at the time required and imposed by law.

2.6 As collateral security for the prompt and complete payment of the Purchase Price when due, at the Closing Curadis shall grant to the Sellers a security interest in all of right, title and interest in all of the Purchased Assets (the “Collateral”). The security interest granted will be senior to all other liens with respect to the Collateral, except to the extent otherwise required by law. The grant of the security interest shall be effected by a security agreement (the “Security Agreement”), the form of which is set forth in Exhibit 2.6 attached to this Agreement. The foregoing security interest will be released upon payment in full of the Final Payment (as defined in Section 3.1(c) below).

ARTICLE 3

PURCHASE PRICE; TIMING OF PAYMENTS; DISCHARGE OF CERTAIN DEBTS

3.1 The purchase price for the Purchased Assets (the “Purchase Price”) and the rights under the Agreement shall be 4,200,000 euros, subject to reduction as set forth below. The Purchase Price shall be payable as follows:

|

(a)

|

Deposit Payment - 50,000 euros, which amount was delivered to Sellers on September 8, 2009 following the execution and delivery of the August 25, 2009 letter agreement. Sellers hereby acknowledge receipt of the 50,000 euros payment.

|

|

(b)

|

Closing Payment – 300,000 euros to be delivered at the Closing by bank transfer to GCEH on behalf of Sellers.

|

|

(c)

|

Final Payment - 2.0 Million euros (the “Final Payment”). The Final Payment shall be paid from the following sources:

|

|

(i)

|

Curadis will pay Sellers a royalty based on of 2% of Net Sales derived from direct commercialization of Covered Products by Curadis or one of its Affiliates.

|

|

(ii)

|

In the event that Curadis grants a license to a product that constitutes a Covered Product or which otherwise includes a license to any of the intellectual property rights transferred as part of the Purchased Assets, Sellers will receive the following:

|

|

a.

|

Curadis will pay Sellers 5% from any “up front license fee,” “milestone payment” or other lump sum payment that Curadis receives from time to time from such licensor.

|

|

b.

|

if the license agreement between Curadis and a licensee provides that the licensee is obligated to pay a royalty equal to 4% of Net Sales or less, then Curadis shall pay to Sellers one half (50%) of the royalties that such licensee is required to pay under the license (the other 50% of such royalty shall be payable to Curadis).

|

|

c.

|

if the license agreement between Curadis and a licensee provides that the licensee is obligated to pay a royalty of more than 4% of Net Sales, then Curadis shall ensure that the licensee pays to Sellers 2% of the Net Sales generated by the licensee (any excess royalty shall be paid to Curadis).

|

After Sellers have received an aggregate amount of 2 Million euros under this Section 3.1(c) equal to the Final Payment, all future income and/or royalty payments shall be made to, and belong to Curadis.

Notwithstanding the foregoing, the amount of the Final Payment may be reduced as follows: (i) If before the later of December 31, 2010 or the date of the First Commercial Sale the Russian Patent is not re-instated, the Final Payment shall be reduced by 100,000 euros; (ii) If before the later of December 31, 2010 or the date of the First Commercial Sale the Australian Patent is not re-instated, the Final Payment shall be reduced by 100,000 euros. Curadis may pre-pay the Final Payment, in whole or in part, at any time without any penalty.

|

(d)

|

Obtaining the full release of the Sellers’ obligations to pay the liquidator of Savetherapeutics AG, any future payments, including the remaining 1,850,000 euro unpaid portion of the purchase price under the Savetherapeutics Contract.

|

3.2 In addition to the foregoing payments of the Purchase Price, on the Closing, Curadis shall assume and shall be financially responsible for:

(a) Sellers’ actual or potential obligation to Marc Kessemeier under the Consulting Agreement between Marc Kessemeier and Sellers or otherwise, provided that Curadis shall not be responsible for any amount over 21,000 euros.

(b) Sellers’ actual or potential obligation to Prof. Dr. Wieland, provided that Curadis shall not be responsible for any amount over 205,000 euros.

(c) The financial obligations of Sellers arising under the assigned contracts attached to this Agreement as Exhibit 3.2(a); provided, however, that the benefit of each of such assigned contracts (the “Assigned Contracts”) has been validly assigned to Curadis in accordance with the terms thereof.

(d) To the extent not paid by Curadis prior to the Closing, all fees and costs arising after August 25, 2009 related to (i) the prosecution and maintenance of any of the patents or patent applications included in the Purchased Assets (including the payment of all patent filing and maintenance fees payable to any U.S., European or other patent office, and all legal fees payable to patent lawyers, whether or not engaged by Sellers), and (ii) the Schmidt Litigation, including all legal fees and costs to be owed to Huschke-Rechtsanwaelte.

ARTICLE 4

CONDITIONS TO THE CLOSING; CLOSING

4.1. Closing. The Closing of the transactions contemplated hereby shall occur on or before November __, 2009 (the “Closing Date”), or such other date as the Parties may mutually agree to in writing.

4.2 Conditions Precedent to Curadis’ Closing Obligations Each of the following shall be a condition to the obligation of Curadis to consummate the transactions contemplated by this Agreement, except to the extent that Curadis may elect to waive any of such conditions in writing:

(a) The liquidator of Savetherapeutics shall have consented in writing to the assignment and transfer of the Savetherapeutics Contract and the Purchased Assets to Curadis, and shall have consented to the other transactions contemplated by this Agreement, to the extent such consent is necessary.

(b) Curadis shall have received executed copies of all patent assignments, bills of sale and other documents and instruments necessary to sell, transfer and assign to Curadis all of the Purchased Assets.

(c) Curadis shall have received a certificate, executed by the Chief Executive Officer of each Seller, confirming that (i) each of the representations and warranties made by such Seller in this Agreement is true and correct in all material respects on and as of the Closing as though such representation or warranty was made on and as of the Effective Date, as well as on and as of the Closing, and (ii) such Seller has performed and complied with, in all material respects, each agreement, covenant and obligation required by this Agreement to be so performed or complied with by such Seller at or before the Closing.

(d) The Assigned Contracts listed in Exhibit 3.2(a) have been validly assigned to Curadis in accordance with the terms thereof.

4.3 Conditions Precedent to Sellers’ Closing Obligations Each of the following shall be a condition to the obligation of Sellers to consummate the transactions contemplated by this Agreement, except to the extent that Sellers may elect to waive any of such conditions in writing:

(a) The liquidator of Savetherapeutics shall have consented in writing to the assignment and transfer of the Savetherapeutics Contract and the Purchased Assets, and shall have consented to the other transactions contemplated by this Agreement, to the extent such consent is necessary.

(b) Curadis shall have executed the Security Agreement.

(c) Sellers shall have received an instrument, in form and substance reasonably satisfactory to Sellers, in which the liquidator of Savetherapeutics fully releases Sellers from any and all obligations and liabilities under the Savetherapeutics Contract, including all the obligations to pay the liquidator the remaining 1,850,000 euro unpaid portion of the purchase price under the Savetherapeutics Contract.

(d) Sellers shall have received one or more instruments, in form as provided in Exhibit 4.3 (d); executed by the parties to the Assigned Contracts, in which Curadis assumes all of the obligations of Sellers under the Assigned Contracts, and Sellers are released from all obligations under the Assigned Contracts.

(e) Sellers shall have received evidence, reasonably satisfactory to Sellers, that all fees, costs and other obligations required to be paid and satisfied by Curadis under Section 3.2(b) have been paid or otherwise satisfied in full.

(f) Sellers shall have received a certificate, executed by the Managing Director of Curadis, confirming that (i) each of the representations and warranties made by Curadis in this Agreement is true and correct in all material respects on and as of the Closing as though such representation or warranty was made on and as of the Closing, and (ii) Curadis has performed and complied with, in all material respects, each agreement, covenant and obligation required by this Agreement to be so performed or complied with by Curadis at or before the Closing.

4.4 Closing Deliveries of Sellers. At or prior to the Closing, each Seller shall execute and deliver to Curadis:

(a) Patent assignments, bills of sale and other such assignment instruments, in form and substance reasonably satisfactory to Curadis, covering the Purchased Assets and the Assigned Contracts, and otherwise effecting the full sale and conveyance of the Purchased Assets to Curadis, free and clear of all liens, security interests and other encumbrances other than those listed in this Agreement.

(b) All originals, books, records, correspondence and other documents in Sellers’ possession or control that evidence or relate to the Purchased Assets and the Product;

(c) The Closing certificate described above in Section 4.2(c); and

(d) Such other closing documents as Curadis may reasonably request in order to consummate the transactions contemplated by this Agreement.

4.5 Closing Deliveries of Curadis. At or prior to the Closing, Curadis shall execute and deliver to Sellers:

(a) Payment, by bank transfer, of 300,000 euros;

(b) The Closing certificate described above in Section 4.3(f);

(c) The Security Agreement; and

(d) Such other closing documents as Sellers may reasonably request in order to consummate the transactions contemplated by this Agreement.

ARTICLE 5

COVENANTS AND CONTINUING OBLIGATIONS

5.1 The Parties agree to jointly use their commercially reasonable efforts to obtain the consent of the liquidator of Savetherapeutics to the sale and transfer of the Purchased Assets to Curadis under this Agreement and to the other transactions contemplated hereby. The Parties agree to cooperate in good faith in dealing with the liquidator and to persuade the liquidator to approve the proposed transactions. Notwithstanding the foregoing, nothing herein shall require any of the Parties to make any payments to, or to otherwise provide any consideration to the liquidator in order to obtain the liquidator’s consent.

5.2 Sellers shall be entitled to retain one copy of any document delivered by Sellers under this Agreement, but only in their legal files for evidentiary purposes.

5.4 It is expressly understood and agreed that Curadis is not the successor to Sellers or any of their affiliates in their business affairs, and Curadis undertakes no responsibility, obligation or liability, expressed or implied, under any contract of Sellers that are not Assigned Contracts, and that such other contracts shall remain the sole responsibility of Sellers.

5.5 For the period of five (5) years from the Closing, neither of Sellers, nor any of their Affiliates shall be a party to, or assist with or undertake, either on their own, with third parties or on behalf of third parties, any research and development with respect to the Covered Product or any product which could be used in reasonable substitution thereof, nor commercialize any products based on the Covered Product, except if and as requested by Curadis.

5.6 Curadis shall keep, and shall require that its Affiliates and each licensee keep, complete and accurate books of account and records in sufficient detail to enable the expenses incurred by Curadis and its Affiliates and any licensee and the amounts payable under this Agreement to be determined. Such books and records shall be kept at the principal place of business of Curadis or its accountant, its Affiliate or such blicensee, as the case may be, for at least sixty (60) months following the end of the calendar year to which such books and records pertain; provided, however, that in the event Sellers conduct an audit and a dispute arises over the accuracy of reports or payments, Curadis, its Affiliates and each licensee, as the case may be, shall retain all applicable books of account and records and continue to permit access to such books of account and records until the resolution of such dispute.

5.7 Upon reasonable prior written notice from Sellers and not more than once in each calendar year until the Final Payment referred to in Section 3.1(c) has been paid in full (unless an audit reveals inaccurate reports or payments), Curadis shall permit, and shall require its Affiliates and each licensee to permit, an independent certified public accounting firm of nationally recognized standing in the United States or Germany selected by Sellers and reasonably acceptable, as the case may be, to Curadis, its Affiliate or the licensee to have access during normal business hours to such books of account and records of Curadis, and its Affiliates and each a licensee that are relevant for calculation of the Final Payment, at such person’s or entity’s principal place of business, as may be reasonably necessary to verify the accuracy of the reports and payments provided by Curadis for any calendar year ending not more than sixty (60) months prior to the date of such request.

5.8 After the First Commercial Sale, Curadis shall furnish to Sellers a written report for each calendar quarter showing: (a) the aggregate amount of gross sales and other dispositions of all Covered Products (broken-out by Covered Product) sold or other disposed of by Curadis, its Affiliates and any licensees during such calendar quarter and the calculation of Net Sales from such amount, and (b) the amount of royalties which shall have accrued under this Agreement based upon such Net Sales. Reports to be provided by Curadis to Sellers under this Section 5.8 shall be due forty-five (45) days following the end of each calendar quarter. If for any quarter following the First Commercial Sale, there were no Net Sales, a report stating such fact shall be due within forty-five (45) days following the end of such quarter. A responsible financial officer of Curadis (or that officer’s responsible designee) shall certify in writing that each report provided under this Section 5.8 is correct and complete. The obligation to provide reports under this Section 5.8 shall continue until the Final Payment referred to in Section 3.1(c) has been paid in full.

5.9 Curadis hereby agrees that from and after the Effective Date, Curadis shall continue to vigorously prosecute the Schmidt Litigation at the sole expense of Curadis. After the Effective Date until the Closing, Curadis shall control and direct the Schmidt Litigation, provided that Curadis shall (x) promptly inform Sellers of all instructions that it provides Huschke-Rechtsanwaelte and of all other actions that it takes with respect to such litigation, and (y) not settle or otherwise terminate the Schmidt Litigation before the final judgment is rendered without the prior written consent of Sellers. Sellers shall fully cooperate with Curadis in prosecuting the Schmidt Litigation at the sole expense of Curadis. Curadis shall advance (or if paid by Sellers, reimburse) all of the reasonably incurred out-of-pocket expenses of Sellers and their representatives (including legal fees and costs), in furnishing such assistance requested by Curadis. If Curadis elects not to step-in or take over the Schmidt Litigation in its own name, or if stepping-in/taking-over and defending the Schmidt Litigation by Curadis is not legally possible, Sellers shall continue to prosecute such litigation as instructed by Curadis, and shall not settle the claims at their own discretion unless Curadis approves such settlement in advance. However, Curadis shall be entitled to defend and settle the Schmidt Litigation at its own discretion. Notwithstanding anything herein to the contrary, Curadis shall not settle the Schmidt Litigation in a manner that results in monetary damages to Sellers without Sellers approval.

5.10 Curadis covenants and agrees with the Sellers that from and after the date of this Agreement and until the Final Payment has been paid in full, at any time and from time to time, upon the written request of the Sellers, and at the sole expense of Curadis, Curadis will promptly and duly execute and deliver any and all such further documents and take such further action as the Sellers may reasonably deem desirable to obtain the full benefits of the security interest granted in the Collateral and of the rights and powers granted in the Security Agreement, including, without limitation, the filing of any financing statements or documents under any jurisdiction with respect to the security interests granted in the Security Agreement, the filing of any other documentation as may be required to create or perfect the security interest in any jurisdiction, and the execution, delivery and recordation of such assignments of patents as may be necessary to effectuate, perfect, and record the Sellers’ security interest in the Collateral.

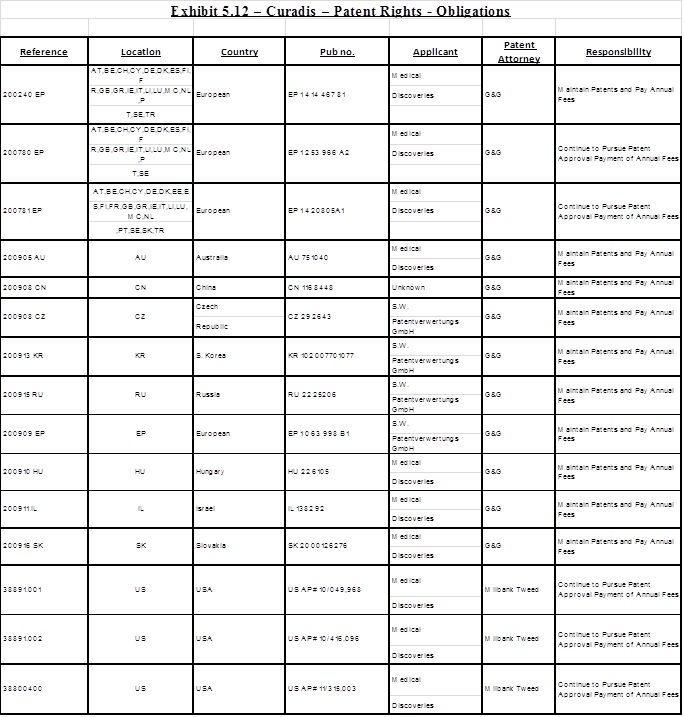

5.11 Commencing on the Closing Date and continuing until the Final Payment has been fully satisfied, Curadis shall assume, in coordination with Sellers, full responsibility for the application, maintenance, reexamination, reissue, reinstatement, opposition and prosecution of any kind (collectively “Prosecution”) relating to the Patent Rights in all jurisdictions, including, but not limited to, payment of all costs, fees and expenses related thereto. Curadis shall have the right to select counsel with respect to the responsibility assumed by Curadis in this Section 5.12, and Curadis shall diligently pursue the Prosecution of the Patent Rights. Curadis shall, at Sellers’ request, provide Sellers with (i) evidence that the Patent Rights are being maintained in accordance with this Section, and (ii) copies of any and all communications with any patent authorities or patent office regarding the Prosecution of the Patent Rights. Curadis shall obtain the prior written consent of Sellers (which consent shall not be unreasonably withheld or delayed), prior to abandoning, disclaiming, withdrawing, seeking reissue or allowing to lapse any material patent, or patent application relating to the Patent Rights listed on Exhibit 5.12.

ARTICLE 6

REPRESENTATIONS AND WARRANTIES

6.1 Sellers represent and warrant to Curadis as of the Effective Date and at the Closing as follows:

(a) Each Seller is a corporation duly and validly existing and in good standing under the laws of the state of its incorporation. MDI is a corporation wholly-owned by GCEH. Sellers have all requisite corporate power and authority to own their respective assets, including the Purchased Assets, and to carry on their business as presently conducted.

(b) Sellers have all requisite power and authority to execute and deliver and perform their obligations under this Agreement and to consummate the transactions contemplated by this Agreement.

(c) All acts (corporate or otherwise) required to be taken by or on the part of, and all approvals required to be obtained by, Sellers necessary to enter into this Agreement, consummate the transactions contemplated by this Agreement and perform its obligations under this Agreement have been duly and properly taken by Sellers.

(d) This Agreement has been duly and validly executed and delivered by Sellers, and constitutes the legal, valid and binding obligation of Sellers enforceable against Sellers in accordance with its terms, subject to applicable bankruptcy, moratorium, reorganization, insolvency and similar laws of general application relating to or affecting the rights and remedies of creditors generally and to general equitable principles (regardless of whether a proceeding is brought in equity or at law).

(e) The Purchased Assets do not constitute all or substantially all of the assets of Sellers, on a consolidated basis.

(f) The execution and delivery of this Agreement by Sellers, the consummation by them of the transactions contemplated by this Agreement, and the performance by them of their obligations under this Agreement does not, and will not at all relevant times (i) violate or conflict with any provision of their respective Certificates of Incorporation or By-Laws, or (ii) result in a violation by Sellers of any law to which they or any of its properties or assets are subject, or (iii) violate, or conflict with, or result in a breach of any provision of, or constitute a default (or give rise to any right of termination, cancellation or acceleration) under, any of the terms, conditions or provisions of any agreement lease, instrument, obligation, understanding or arrangement to which either of Sellers is a party or by which any of their properties or assets is subject.

(g) Except for the Schmidt Litigation, there is no litigation, proceeding, investigation, arbitration or claim pending, or, to the best of the knowledge of Sellers, threatened against Sellers, and there is, to the best of Sellers’ knowledge, no reasonable basis for any such action, which affects in whole or in part Sellers’ ability to consummate the transactions contemplated by this Agreement, the performance of Sellers’ obligations hereunder or the ability of Curadis to fully enjoy the Purchased Assets.

(h) To the best of Sellers’ knowledge, (i) the use of the Purchased Assets does not infringe intellectual property rights of third parties, except to the extent as may have been alleged in the Schmidt Litigation, (ii) the Purchased Assets are free from any liens, charges and Encumbrances or other rights of third parties, (iii) the full enjoyment of the Purchased Assets are not dependant on any rights of third parties, (iv) no fraudulent or other improper document has been filed with any third governmental agency which may invalidate any of the rights enjoyed by the Purchased Assets, and (v) the Purchased Assets are valid and enforceable against third parties, and there are no grounds for revocation, invalidation or re-examination of any of the Purchased Assets.

(i) No permit, consent, approval or authorization of, or declaration, filing or registration with, any governmental authority or other third party is or will be necessary to be made or obtained by Sellers in connection with (i) the execution and delivery by Sellers of this Agreement, (ii) the consummation by them of the transactions contemplated under this Agreement, or (iii) the performance by Sellers of their obligations under this Agreement.

(j) The Assigned Contracts are being duly assigned to Curadis at Closing and duly authorized, executed and delivered by Sellers and constitute the legal, valid and binding obligation of Sellers enforceable against Sellers in accordance with their terms, subject to applicable bankruptcy, moratorium, reorganization, insolvency and similar laws of general application relating to or affecting the rights and remedies of creditors generally and to general equitable principles (regardless of whether a proceeding is brought in equity or at law). Sellers have not terminated the Assigned Contracts, nor have Sellers received any written notice from any of the other parties to any of the Assigned Contracts that the Assigned Contracts have been breached or terminated.

(k) To the best of Sellers’ knowledge, Sellers have no liability to any party to the Assigned Contracts other than the liabilities specified in the Assigned Contracts. Sellers have not received from any party to the Assigned Contracts any written notices (i) asserting any breach of the Assigned Contracts, (ii) terminating or modifying any of the Assigned Contracts, or (iii) otherwise challenging the terms and provisions of the Assigned Contracts.

(l) Sellers have not granted to any third parties any rights relating to the Product or the Covered Product or relating in any way to any of the rights acquired by Sellers pursuant to the Savetherapeutics Contract, except for third party rights that have expired or been terminated.

6.2 Curadis represents and warrants to Sellers as follows:

(a) Curadis is a company duly organized, validly existing and in good standing under the laws of Germany and has all requisite power and authority to own its assets and to carry on its business as presently conducted.

(b) Curadis has all requisite power and authority to execute and deliver and perform its obligations under this Agreement and the Security Agreement and to consummate the transactions contemplated by such agreements.

(c) All acts (corporate or otherwise) required to be taken by or on the part of, and all approvals required to be obtained by, Curadis necessary to enter into this Agreement and the Security Agreement, consummate the transactions contemplated by this Agreement and the Security Agreement, and perform its obligations under this Agreement and the Security Agreement have been duly and properly taken by Curadis.

(d) This Agreement and the Security Agreement have been duly and validly executed and delivered by Curadis and constitute the legal, valid and binding obligations of Curadis enforceable against Curadis in accordance with their terms, subject to applicable bankruptcy, moratorium, reorganization, insolvency and similar laws of general application relating to or affecting the rights and remedies of creditors generally and to general equitable principles (regardless of whether a proceedings is brought in equity or at law).

(e) The execution and delivery of this Agreement by Curadis, the consummation by it of the transactions contemplated by this Agreement, and the performance by it of its obligations under this Agreement does not, and will not at all relevant times (i) violate or conflict with any provision of its operative governing documents, (ii) result in a violation by Curadis of any law to which it or any of its properties or assets are subject, or (iii) violate, or conflict with, or result in a breach of any provision of, or constitute a default (or give rise to any right of termination, cancellation or acceleration) under, any of the terms, conditions or provisions of any agreement lease, instrument, obligation, understanding or arrangement to which Curadis is a party or by which any of its properties or assets is subject.

ARTICLE 7

INDEMNIFICATION

7.1 From and after the Closing, Sellers shall defend, indemnify and hold harmless Curadis and its officers, directors, employees, consultants and agents from and against all liabilities, claims, damages, costs and expenses (including reasonable attorney's fees) incurred by Curadis and its officers, directors, employees, consultants and agents arising from or out of (a) any breach of or inaccuracy in any representation or warranty made by Sellers in this Agreement, or (b) any breach of any covenant or agreement made by Sellers in this Agreement, (c) the Assigned Contracts, other than the agreements between Sellers and the Liquidator of Savetherapeutics AG i.L., to the extent the liability or cause for such claim was existing before or on the Effective Date, or (d) any claim against Curadis by a party to the Assigned Contracts based on Sellers’ fraud or willful misconduct under such agreements.

7.2 From and after the Closing, Curadis shall defend, indemnify and hold harmless Sellers and their officers, directors, employees, consultants and agents from and against all liabilities, claims, damages, costs and expenses (including reasonable attorney's fees) incurred by Sellers and their officers, directors, employees, consultants and agents arising from or out of (a) any breach of or inaccuracy in any representation or warranty made by Curadis in this Agreement, (b) any breach of any covenant or agreement made by Curadis in this Agreement, or (c) the Assigned Contracts to the extent the liability or cause for such claim was created after the Effective Date.

7.3 No obligation of indemnification shall arise relating to a third party claim or cause of action unless the indemnified Party making such claim shall: (a) notify the indemnifying Party of such claim promptly upon becoming aware of the existence or threatened existence of any such claim giving rise to, or that may give rise to a claim of indemnification hereunder, and (b) allow the indemnifying Party full control over the defense of such claim, and (c) cooperate in the defense of such claim at the indemnifying Party’s expense. Notwithstanding any contrary provision in this Article, the failure to so notify, provide information and assistance shall not relieve the indemnifying Party of its obligations to the indemnified Party hereunder unless, and then only to the extent that the indemnifying Party is materially prejudiced thereby. If the indemnifying Party does not timely acknowledge its indemnification obligation hereunder with respect to such claim, or does not defend such claim, the indemnified Party shall have the right, but not the obligation, to defend and settle such claim until such time as the indemnifying Party acknowledges in writing its indemnification obligation hereunder with respect to such claim or elects in writing to defend and settle such claim in accordance with the indemnification provisions herein. The indemnified Party shall, at its own cost, have the right to participate in any legal proceeding, settlement negotiation or other like event, and to contest and defend a claim and to be represented by legal counsel of its choosing, but shall have no right to settle a claim without the prior written approval of the indemnifying Party.

7.4 Each Party shall cooperate with and provide to the other all information and assistance which the latter may reasonably request in connection with any claim entitling any party to indemnification hereunder.

7.5 No party shall be responsible for or bound by any settlement that imposes any obligation on it that is made without its prior written consent, which consent shall not be unreasonably withheld, conditioned or delayed.

7.6 For avoidance of any doubt, this Section applies to the situation when (a) all Parties are named defendants, as well as (b) any one Party is named a defendant and deems that it may have any right to recourse or indemnification against the other Party under this Agreement.

7.7 The foregoing indemnification provisions are in addition to, and not in derogation of or to the exclusion of, any statutory or common law remedy any Party may have for breach of representation, warranty, or covenant.

ARTICLE 8

CONFIDENTIALITY

8.1 For purposes of this Agreement, “Confidential Information” shall mean information and data in any medium, including oral, written or electronic, disclosed in connection with this Agreement, relating to the Purchased Assets or the transactions contemplated by this Agreement, along with any trade secrets, business information, technical information, or marketing information that the party disclosing the information deems confidential and has appropriately marked as such prior to disclosing such information to the receiving party. The terms and conditions of this Agreement (but not its existence) are deemed to be Confidential Information that shall not be disclosed to third parties without the written consent of the Parties, with the exception of any regulatory filings (including, without limitation, Sellers’ obligation to file a report on Form 8-K with the U.S. Securities and Exchange Commission and to issue a press release in connection with the execution and delivery of this Agreement), press releases as set forth in Section 9.12, or disclosures to investors or shareholderes that a Party may be required to make under either applicable laws and regulations. Irrespective of the foregoing, Confidential Information shall not include information that (a) was reported as nonconfidential by either Party in writing prior to disclosure, (b) was lawfully in the public domain prior to Closing, or becomes publicly available other than through breach of this Agreement, (c) is publicly disclosed pursuant to legal, judicial or administrative proceedings or otherwise required by law (including, without limitation, regulations promulgated by the U.S. Securities and Exchange Commission), subject to Sellers giving all reasonable prior notice and assistance to Curadis to allow it to seek protective or other court orders, (d) is approved for release in writing by Curadis, and/or (e) Curadis will use in order to exercise its rights under this Agreement, including but not limiting to, required disclosure made to regulatory and other authorities, and disclosures made pursuant to confidentiality agreements to its Affiliate(s) and potential partners and licensees. From and after the Closing, all Confidential Information relating to the Purchased Assets shall be deemed to be Confidential Information belonging to Curadis.

8.2 Each Party shall:

(a) strictly protect and maintain the confidentiality of the Confidential Information belonging to the other Party with at least a reasonable standard of care that is no less than that which they use to protect similar confidential information of their own;

(b) not disclose, nor allow to be disclosed, the Confidential Information belonging to the other Party to any person other than to employees, consultants and counsel, on a need to know basis; provided, however, that such recipients of the Confidential Information are bound by obligations of confidentiality no less strict than those contained herein;

(c) unless otherwise expressly provided for in this Agreement, not use the Confidential Information belonging the other Party for any purpose other than in relation to the exercise of its rights and obligations under this Agreement; and,

(d) take all necessary precautions to restrict access of the Confidential Information belonging to any other Party to unauthorized personnel; and immediately notify the Party to which the Confidential Information belongs in the event of any unauthorized disclosure or loss of such Confidential Information.

8.3 Sellers shall not publish or otherwise disclose any Confidential Information about or in relation to the Purchased Assets generated or known to them before or after the Effective Date, without the explicit prior written approval of Curadis.

8.4 No Party shall assert that anything disclosed or discussed constitutes a waiver of attorney-client privilege or attorney work-product.

8.5 The Parties acknowledge and agree that monetary damages may not be adequate in the event of a default under this Article and that the non-defaulting Party shall be entitled, without the posting of a bond, to seek injunctive relief by a court or other body granting such relief, in which event such relief or receipt of monetary damages shall not constitute an election of remedies; and the non-defaulting Party is independently entitled to each and every remedy available by law for a default under this Article.

8.6 The provisions of this Article, from and after the Effective Date, shall supersede and fully replace any confidentiality obligations established between the Parties in relation to the Purchased Assets prior to the Effective Date.

ARTICLE 9

MISCELLANEOUS

9.1 Notice. All notices, requests, demands or other communications to or upon the respective Parties hereto shall be deemed to have been given or made the earlier of (a) actual receipt or refusal to accept receipt, (b) two (2) business days after deposit with a recognized overnight courier service, (c) receipt by facsimile or electronic means, when such delivery is confirmed by the recipient or his agent, or (d) five business days after mailing when deposited in the mails, registered mail or certified, return receipt requested, postage prepaid, addressed to the respective party at the following address (or to such other person or address as is specified elsewhere in this Agreement for specific purposes):

If to Curadis: Curadis GmbH

Henkestr. 91,

91052 Erlangen, Germany

Attention to: Martin Windisch

If to Global Clean Energy Holdings, Inc. (Medical Discoveries, Inc.) or MDI Oncology, Inc.:

Global Clean Energy Holdings, Inc.

6033 W. Century Blvd, Suite 895

Los Angeles, CA 90045

Attention: Richard Palmer

The above addresses for receipt of notice may be changed by any Party by notice, given as provided herein, which notice shall be effective only upon actual receipt.

9.2 Entire Agreement. This Agreement contain the entire understanding of the Parties with regard to the transactions contemplated by this Agreement, superseding in all respects any and all prior oral or written agreements or understandings pertaining to the subject matter hereof. This Agreement can be amended, modified or supplemented only by an agreement in writing which is signed by the Parties to be charged.

9.3 Incorporation of Exhibits and Schedules. The Exhibits, Appendices and Schedules attached to this Agreement are incorporated herein and are hereby made a part of this Agreement.

9.4 Severability. If and to the extent that any court of competent jurisdiction holds any provision or part of this Agreement to be invalid or unenforceable, such holding shall in no way affect the validity of the remainder of this Agreement before any other court or in any other jurisdiction.

9.5 Successors and Assigns. This Agreement shall inure to the benefit of and be binding upon the successors and permitted assigns of the Parties.

9.6 Assignment. The benefits of this Agreement (but not the obligations set forth hereunder) can be assigned or otherwise transferred in whole or in part by either party without the transferring party receiving prior written consent of the other party; provided, however, that the rights of the non-transferring party under this Agreement remain unaffected.

9.7 Waiver. A waiver by any party of any of the terms and conditions of this Agreement in any instance shall not be deemed or construed to be a waiver of such term or condition for the future.

9.8 Headings. Headings in this Agreement are included for ease of reference only and have no legal effect.

9.9 Counterparts. This Agreement may be executed in two or more counterparts (the Parties intend to execute six counterparts), each of which shall be deemed an original and all of which together shall constitute one and the same instrument.

9.10 Applicable Law. This Agreement shall be governed by and construed in accordance with the laws of the Federal Republic of Germany, without regard to the principles of conflicts of law. Any dispute arising out of or in connection with this contract, including any question regarding its existence, validity or termination, shall be referred to and finally resolved by arbitration under the UNCITRAL Arbitration Rules, which Rules are deemed to be incorporated by reference into this clause. Any arbitration commenced pursuant to this clause shall be administered by the London Court of International Arbitration (LCIA). The appointing authority shall be the LCIA. The standard LCIA administrative procedures and schedule of costs shall apply. The number of arbitrators shall be one. The place of arbitration shall be London, England. The language to be used in the arbitral proceedings shall be English. The governing law of the contract shall be the substantive law of Federal Republic of Germany. The arbitrators shall apportion the expenses of the arbitration (including the legal fees and expenses incurred by the parties) between the parties. Any judgment of the arbitrators shall be enforceable in any court of competent jurisdiction.

9.11 Further Assurances. The Parties shall provide, grant and/or execute any additional documents or declarations and shall provide any other assistance that may reasonably be requested to enable Curadis to acquire and manage the Purchased Assets properly and in full. Except (a) as otherwise provided herein to the contrary, and (b) for the costs of recording any assignments to Curadis for the Patent Rights in patent offices worldwide, which cost shall be at the expense of Curadis, each of the Parties shall bear its own expenses, including without limitation the expenses relating to the duplication and delivery of documents and the expenses relating to the preparation of this Agreement, the documents referred to herein and the actions being taken (whether before or after the Effective Date) to enable such Party to comply with its representations, warranties, covenants and agreements contained herein.

9.12 Press Release. The Parties shall have the right to issue press releases relating to its entry into this Agreement; provided, however, that prior to release, the releasing Party provides the other Parties with a draft of the press release in sufficient time for the non-releasing Party to comment on the release. At no time shall any Party issue a release which places the other Parties at risk with any governmental authority as such relates to its public company position.

9.13 Termination of Agreement. Curadis or Sellers may terminate this Agreement as provided below:

(a) Curadis and Sellers may terminate this Agreement by mutual written consent of all three parties at any time prior to the Closing Date;

(b) Subject to Section 9.13(f) below, Curadis may terminate this Agreement by giving written notice to Sellers at any time prior to the Closing Date in the event Sellers are in breach, and Sellers may terminate this Agreement by giving written notice to Curadis at any time prior to the Closing Date in the event Curadis is in breach, of any material representation, warranty, or covenant contained in this Agreement in any material respect; provided, however, that the party in breach shall have ten calendar days to cure such breach;

(c) Curadis may terminate this Agreement by giving written notice to Sellers at any time prior to the Closing Date if the Closing shall not have occurred on or before the 30th day following the date of this Agreement by reason of the failure of any condition precedent under Section 4.2 above (unless the failure results primarily from Curadis itself breaching any representation, warranty, or covenant contained in this Agreement);

(d) Sellers may terminate this Agreement by giving written notice to Curadis at any time prior to the Closing Date if the Closing shall not have occurred on or before the 30th day following the date of this Agreement by reason of the failure of any condition precedent under Section 4.3 (unless the failure results primarily from Sellers breaching any representation, warranty, or covenant contained in this Agreement);

(e) In the event of a termination of this Agreement by Curadis or Sellers pursuant to this Section 9.13 (other than pursuant to Section 9.13(b)), all obligations of the parties hereunder shall terminate without liability of any party to any other party. The termination of this Agreement by either party shall not adversely affect any right that a party may have against another party for breach of contract.

SIGNATURE PAGE

In Witness Whereof, the Parties have caused this Agreement to be duly executed in their respective names and on their behalf, on the date first above written.

|

Curadis GmbH

By: /s/ CURADIS GMBH

Title: _________________________

|

Global Clean Energy Holdings, Inc.

By: /s/GLOBAL CLEAN ENERGY HOLDINGS, INC.

Title: _________________________

|

| |

MDI Oncology, Inc.

By: /s/MDI ONCOLOGY, INC.

Title: _________________________

|

EXHIBIT 1.24

Savetherapeutics Contract

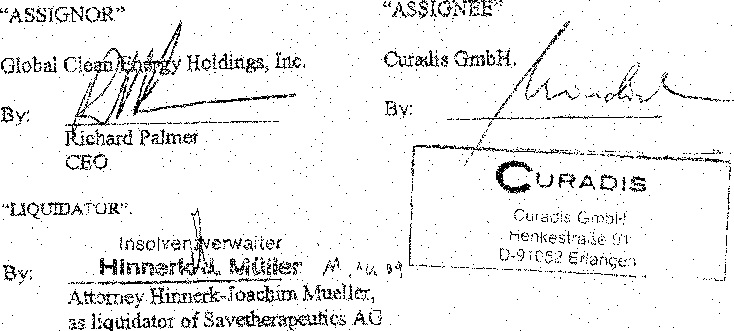

ASSIGNMENT AND ASSUMPTION

AND

CONSENT AGREEMENT

THIS AGREEMET AND ASSUMPTION AND CONSENT AGREEMNT (this “Agreement”) is made as of November ___, 2009 by and among Global Clean Energy Holdings, Inc., a Utah corporation formerly known as Medical Discoveries, Inc. (“Assignor”), Curadis GmbH, a company existing under the laws of the Federal Republic of Germany (“Assignee”), and Attorney Hinnerk-Joachim Mueller as liquidator od Savetherapeutics AG, a German company in liquidation (the “Liquidator”), with reference to the following facts:

WHEREAS, Assignor (then known as “Medical Discoveries, Inc.”) and the Liquidator are parties tot htat certain Sale and Purchase Agreement, dated March 11, 2005, as amended by a side letter (collectively, the “Savetherapeutics Contract”);

WHEREAS, Assignor and MDI Oncology, Inc., Assignor’s wholly-owned subsidiary, on the hand, and Assignee on the other hand, are parties to a certain Sale and Purchase Agreement, dated as of November 16, 2009, (the “Purchase Agreement”); and

WHEREAS, in connection with the transactions contemplated by the Purchase Agreement, Assignor desires to transfer to Assignee any and all right, title and interest it may have in, to and under the Savetherapeutics Contract, and Assignee desires to assume all of Assignor’s responsibilities and obligations in, to and under the Savetherapeutics Contract; and

WHEREAS, the Liquidator is willing to (i) consent to the assignment and assumption of the Savetherapeutics Contract to Assignee, and (ii) release the Assignor from any further obligation and liability under Savetherapeutics Contract.

NOW, THEREFORE, in consideration of the foregoing, of the mutual covenants of the parties hereto, and for other valuable consideration, the receipt and sufficiency of which are hereby acknowledge, it is hereby agreed as follows:

|

1.

|

Assignment of Rights and Benefits. Effective as of November ___, 2009 (the “Closing Date”), Assignor hereby assigns, transfers and sets over unto Assignee, all of the right, title and internet of Debtor in, to and under the Savetherapeutics Contract.

|

|

2.

|

Assumption of Duties by Assignee. Effective as of the Closing Date, Assignee, for itself and its successors and permitted assigns, hereby accepts and assumes and agrees to pay, perform and discharge when due all covenants, conditions, agreements, terms and obligations to be performed by Assignor under the Savetherapeutics Contract accruing or arising before or after the Closing Date (the “Assumed Liabilities”), subject to the covenants, conditions and other provisions contained therein.

|

|

3.

|

Consent and Ratification. The Liquidator hereby consents to (i) the assignment of the Savetherapeutics Contract by Assignor to Assignee, and (ii) the assumption by

|

|

4.

|

successor’s or assigns any rights or remedies of any nature or kind whatsoever under or by reason of this Agreement.

|

|

5.

|

Amendment. This Agreement may not be modified or changed except by written instruments signed by all of the parties hereto. Subject to the restrictions on assignment set forth herein this Agreement shall inure to the benefit of and be binding upon the parties hereto and their respective successors and assigns.

|

IN WITNESS WHEREOF, the parties have executed this Agreement as of the date first above written.

EXHIBIT 2.2

Encumbrances on Purchased Assets

|

1.

|

Claims made by Dr. Alfred Schmidt and Prof. Dr. Wieland regarding rights he may have to certain of the intellectual property included in the Purchased Assets, including those matters in dispute in the Schmidt Litigation.

|

|

2.

|

Rights to certain of the Purchased Assets retained by the Liquidator of Savetherapeutics AG i.L.

|

|

3.

|

Encumbrances in favor of Sellers to be enacted pursuant to the Security Agreement

|

SECURITY AGREEMENT

This Security Agreement (the “Agreement”) is entered into as of November 17, 2009, by and between Curadis GmbH (“Debtor”), with its chief executive office located a Henkestr. 91, 91052 Erlangen, Germany in favor of Global Clean Energy Holdings, Inc., a Delaware corporation (“Secured Party”), with its chief executive office located at 6033 West Century Blvd., Suite 895 Los Angeles, CA 90045, U.S.A., with reference to the following facts:

RECITALS:

|

A.

|

Pursuant to the Sale and Asset Purchase Agreement, entered into as of the November 13, 2009 by and between Debtor and Secured Party and MDI Oncology, Inc. (the wholly-owned subsidiary of Secured Party) (the “Sale Agreement”), Debtor acquired, as of Closing, certain intellectual property and other rights, including all of the rights of Secures Party and MDI Oncology, Inc. to the patents and/or patent applications listed in Schedule B to this Agreement.

|

|

B.

|

Pursuant to the Sale Agreement, Debtor has agreed to pay Secured Party and MDI Oncology, Inc. that certain Final Payment based on the commercial exploitation of the Covered Products.

|

|

C.

|

Pursuant to the Sale Agreement, Debtor agreed to (i) grant Secured Party and MDI Oncology. Inc. a security interest in the Purchased Assets as security for Debtor’s obligations to pay the Final Payment under the Sale Agreement, and (ii) execute and deliver this Security Agreement, and to grant to Secured Party and MDI Oncology, Inc. a security interest in the Purchased Assets.

|

|

D.

|

Secured Party, being the sole shareholder of MDI Oncology, Inc. is acting as the representative of MDI Oncology, Inc. for the purposes of this Agreement.

|

AGREEMENT:

NOW THEREFORE, in consideration of the promises and mutual covenants herein contained, and for other good and valuable consideration, the receipt and sufficiency of which are acknowledged, Debtor hereby agrees as follows:

|

1.

|

Definitions. In this Agreement, all terms and expressions shall, in the absence of contrary intention or unless otherwise defined in this Agreement, have the meanings attributed to such terms in the Sale Agreement.

|

|

2.

|

Grant of Security Interest in Intellectual Property Collateral. As security for the Obligations (as defined in paragraph 3 below), Debtor hereby grants to Secured Party a continuing firs-priority (except to the extent otherwise required by law) security interest (the “Security Interest”) in all of Debtor’s right, title, and interest in, to and under the Patent Rights and the other intellectual property constituting the Purchased Assets (collectively, the “Intellectual Property Collateral”).

|

|

3.

|

Obligations Secured. This Agreement is given for the purpose of securing, as a first-priority security interest, the following obligations of Debtor to Secured Party and MDI Oncology, Inc. (the “Obligations”):

|

|

(1)

|

The obligation of Debtor to Secured Party to pay the Final Payments, as defined in Section 3.1(c) of the Sale Agreement, according to the terms thereof; and

|

|

(2)

|

Prompt performance and observation of Debtor’s duties under Section 5.12 of the Sale Agreement.

|

|

4.

|

Events of Default: Remedies.

|

|

(1)

|

The occurrence of any of the following events or conditions shall constitute and is hereby defined to be an “Event of Default”:

|

|

(a)

|

A failure to make any royalty payments as part of the Final Payment, which payment default continues unremedied for a period of thirty (30) calendar days after notice of such default or violation to Debtor;

|

|

(b)

|

A material default to comply with Section 5.12 of the Sale Agreement, which default continues unremedied for a period of thirty (30) calendar days after notice of such default or violation to Debtor; and

|

|

(c)

|

Debtor shall go bankrupt, initiates a voluntary bankruptcy procedure, or in case the bankruptcy procedure against Debtor has been brought.

|

|

(2)

|

Upon the occurrence of any Event of Default, and at any time while such Event of Default is continuing, Secured Party may do one or more of the following:

|

|

(a)

|

Declare the remaining unpaid portion of the Final Payment immediately due and payable, and the same, with all costs and charges, shall be collectible thereupon by actin at law.

|

|

(b)

|

Without further notice or demand and without legal process, take possession of the Intellectual Property Collateral wherever found. Debtor, upon demand by Secured Party, shall take whatever actions are deemed necessary by the Secured Party to deliver to the Secured Party full possession and control of the Intellectual Property Collateral.

|

|

(c)

|

Pursue any legal remedy available to collect the Obligations, to enforce its title in and right to possession of the Intellectual Property Collateral, and to enforce any and all other rights or remedies available to it.

|

|

(d)

|

Upon giving Debtor such notice as is required by law, enforce Intellectual Property Collateral at public sale or by other means permitted by applicable law.

|

|

(3)

|

The Proceeds of any sale of all or any part of the Intellectual Property Collateral shall be applied as follows:

|

|

(a)

|

First, to the payment of the reasonable costs and expenses, including reasonable attorney’s fees and legal expenses, incurred by Secured Party in connection with (A) the administration of this Agreement, (B) the custody, preservation, or the sale of, or other realization upon, the Intellectual Property Collateral, or (C) the exercise or enforcement if any of the rights of Secured Party hereunder;

|

|

(b)

|

Second, to the payment of the remaining undisputable and unpaid portion of the Final Payment; and

|

|

(c)

|

Third, the surplus proceeds, if any, to Debtor or to whomsoever shall be lawfully entitled to receive the same or as a court of competent jurisdiction shall direct.

|

|

(4)

|

Secured Party so far as may be lawful, may purchase all or any part of the Intellectual Property Collateral offered at any public sale made in the enforcement of Secured Party’s rights and remedies hereunder.

|

|

(5)

|

Debtor shall pay all reasonable costs and expenses, including without limitation, court costs and reasonable attorneys, fees, incurred by Secured Party in enforcing payment and performance of the Obligations or in exercising the rights and remedies of Secured Party hereunder.

|

|

(6)

|

In addition to the remedies provided herein for an Event of Default, Secured Party shall have the rights and remedies afforded a secured party under applicable law. No failure on the part of Secured Party to exercise any of its rights hereunder arising upon any Event of Default shall be construed to prejudice its rights upon the occurrence of any other or subsequent Event of Default. No delay on the part of Secured Party in exercising any such rights shall be construed to preclude it from the exercise thereof at any time while that Event of Default in continuing. Secured Party may enforce any one or more remedies or rights hereunder successively or concurrently. By accepting payment or performance of any of the obligations after it due date, Secured Party shall not thereby waive the agreement contained herein that time is of essence, its right to require prompt payment or performance when due of the remainder of the obligations, or its right to consider the failure to so pay or perform an Event of Default.

|

|

5.

|

Miscellaneous Provisions.

|

|

(1)

|

Debtor waives and agrees not to assert: (i) any right to require Secured Party to proceed against, or to pursue any other remedy available to Secured Party, or to pursue any remedy in any particular order or manner; (ii) the benefits of any legal or equitable doctrine or principle of marshaling; and (iii) demand, diligence, presentment for payment, protest and demand, and notice of dishonor, protest, demand and nonpayment, relating to the Obligations.

|

|

(2)

|

Until an Event of Default, Debtor may retain possession and control of the Intellectual Property Collateral and may use it in any lawful manner consistent with this Agreement or the Sale Agreement.

|

|

(3)

|

No modification, rescission, waiver, release or amendment of any provision of this Agreement shall be made except by a written agreement signed by a duly authorized officer of Secured Party.

|

|

(4)

|

This Agreement shall remain in full force and effect until all of the Final Payment shall have been paid in full.

|

|

(5)

|

No setoff or claim that Debtor now has or may in the future have against Secured Party shall relieve Debtor form paying or performing the Obligations.

|

|

(6)

|

This Agreement shall be binding upon, and shall inure to the benefit of , the parties hereto and their successors and assigns.

|

|

(7)

|

A photographic or other reproduced copy of this Agreement and/or any financing statement relating hereto shall be sufficient for filling and/or recording as a financing statement.

|

|

(8)

|

Upon the payment in full of the Final Payment, the security interest granted herein and this Agreement shall terminate, and all rights to the Collateral shall revert to Debtor. Upon any such termination, Secured Party and MDI Oncology, Inc., will at Debtor’s sole expense, promptly execute and deliver such documents as Debtor shall reasonably request to evidence such termination.

|

|

(9)

|

This Agreement shall be governed and construed in accordance with the laws of the Federal Republic of Germany, without regard to the principles of conflicts of law. Any dispute arising out of or in connection with this contract, including any question regarding its existence, validity or termination, shall be referred to and finally resolved by arbitration under the UNCITRAL Arbitration Rules, which Rules are deemed to be incorporated by reference into this clause. Any arbitration commenced pursuant to this clause shall be administered by the London Court if International Arbitration (LCIA). The appointing authority shall be the LCIA. The standard LCIA administrative procedures and schedule of costs shall apply. The number of arbitrators shall be one. The place of arbitration shall be London, England. The language to be used in the arbitral proceedings shall be English. The governing law of the contract shall be the substantive law od Federal Republic of Germany. The arbitrators shall apportion the expenses of the arbitration (including the legal fees and expenses incurred by the parties) between the parties. Any judgment of the arbitrators shall be enforceable in any court of competent jurisdiction.

|

IN WITNESS WHEREOF, the Debtor has caused this Agreement to be signed in its name by its duly authorized officer.

Curadis GmbH.

AGREED AND ACCEPTED

Global Clean Energy Holding, Inc.

By:

Debtor: Curadis GmbH

Secured Party: Global Clean Energy Holdings, Inc.

SCHEDULE A TO SECURITY AGREEMENT

DESCRIPTION OF COLLATERAL

All of Debtor’s right, title and interest, whether acquired under the Sale Agreement or hereafter created or acquired, in and to the following described intellectual property (collectively, the “Intellectual Property Collateral”):

|

(1)

|

All of Debtor’s rights in and to the patent and/or patent application listed in Schedule B attached hereto, and any division, continuation-in-part, renewal, extension, reexamination or reissue of each such patent and any and all corresponding U.S. and foreign counterpart patent applications or patents please link this to Exhibit 1.16 of the Sale Agreement.

|

|

(2)

|

All other Purchased Assets, as defines in the Sale Agreement.

|

EXHIBIT 3.2(a)

Assigned Contracts

|

1.

|

Asset Purchase Agreement between Attornay Hinnerk-Joachim Muller as Liquidator of Savetherapeutics AG i.L. and Medical Discoveries, Inc.

|

|

2.

|

Side Letter to the Asset Purchase Agreement between Attorney Hinnerk-Joachim Muller as Liquidator of Savetherapeutics AG i.L. and Medical Discoveries, Inc.

|

|

3.

|

Assignment of Patent, Participation, and Research and Development Agreement between Medical Discoveries Oncology, Inc. and Prof. Dr. Heinrich Wieland.

|

|

4.

|

Amendment No. 1 to the Assignment of Patent, Participation, and Research and Development Agreement between Medical Discoveries Oncology, Inc. and Prof. Dr. Heinrich Wieland.

|

|

5.

|

Consulting Agreement between Marc Kessemeier and Medical Discoveries, Inc.

|

AGREEMENT

THIS AGREEMENT (the “Agreement”) is made as of December 11th, 2009 by and among Prof. Dr. Heinrich Wieland, In der Wiehre 13, 79291 St. Peter, Germany (hereinafter: “Creditor”), Global Clean Energy Holdings, Inc., a Utah corporation formerly known as Medical Discoveries, Inc. (“GCEH”) and MDI Oncology, Inc., a Delaware corporation (“MDI” as collectively with GCEH, “Debtor”), and Curadis GmbH, a company existing under the laws of the Federal Republic of Germany, Henkestr. 91, 91052 Erlangen, Germany (“Assumptor”), with reference to the following facts:

WHEREAS, Debtor and Creditor are parties to that certain Assignment of Patent-Participation-, Research and Development Agreement, dated August 2, 2005, as amended by Amendment No. 1 (collectively, the “Wieland Contract”);

WHEREAS, Debtor and Assumptor are parties to a certain Sale and Purchase Agreement, dated as of November 16, 2009, (the “Purchase Agreement”); and

WHEREAS, in connection with the transactions contemplated by the Purchase Agreement, Debtor desires to transfer to Assumptor any and all right, title and interest it may have in, to and under the Wieland Contract, and Assumptor desires to assume the Debtor’s financial obligations under the Wieland Contract, as stipulated in Sec. 2 and 3 below; and

WHEREAS, Creditor is willing to (i) consent to the transfer of the benefits of Wieland Contract to the Assumptor, and (ii) release the Debtor from its obligation and the Debt under the Wieland Contract.

NOW, THEREFORE, in consideration of the foregoing, of the mutual covenants of the parties hereto, and for other valuable consideration, the receipt and sufficiency of which are hereby acknowledge, it is hereby agreed as follows:

|

1.

|

Assignment of Rights and Benefits. Effective as of December ___, 2009 (the “Closing Date”), Debtor hereby assigns, transfers and sets over unto Assumptor, all of the right, title and internet of Debtor in, to and under the Wieland Contract.

|

|

2.

|

Assumption of Debt. Effective as of the Closing Date, Assumptor hereby accepts and assumes and agrees to pay the Creditor Debtor’s debt under the Wieland Contract, in the amount of 205,000 euros (in words: two-hundred-five-thousand euros) (the “Debt”), subject to the covenants, conditions and other provisions contained therein.

|

|

3.

|

Consent and Ratification. Creditor hereby consents to (i) the assignment, transfer and setting over unto Assumptor of Debtor’s right, title and interest in, to and under the Wieland Contract, and (ii) the assumption of the Debt by the Assumptor, all as of the Closing Date.

|

|

4.

|

Release. By the assumption of the Debt, as set out in Sec 2 and 3 above, the Assumptor steps into the shoes of the Debtor, and the Debtor is forever released and discharged from the financial and other obligations and liabilities under the Wieland Contract.

|

|

5.

|

Further Acts. Each party agrees that it shall, upon the request of the other, executed and deliver such further documents and do so such other acts and things as are reasonably necessary and appropriate to effectuate the terms and conditions of this Agreement.

|

|

6.

|

Binding Effect. This Agreement and all provisions hereof will be binding upon and inure to the benefit of the parties hereto and their respective successors and permitted assigns.

|

|

7.

|

Headings. Headings are provided herein for convenience only and shall not serve as a basis for interpretation or construction of this Agreement, not as evidence of the intention of the parties hereto.

|

|

8.

|

Governing Law. In any action brought by or against the Liquidator, this Agreement shall be governed and construed in accordance with the laws of the Federal Republic of Germany, with the exception of German international private law and the UN Convention on Contracts for the International Sale of Goods. Any dispute between Debtor and Assumptor regarding this Agreement shall be governed but the choice of law, jurisdiction and other provisions of Section 9.10 if the Purchase Agreement.

|

|

9.

|

Counterparts. This Agreement may be executed in counterparts, each of which shall be deemed an original, but all of which together shall constitute but one and the same instrument.

|

|

10.

|

Amendment. This Agreement may not be modified or changed except by written instruments signed by all of the parties hereto.

|

IN WITNESS WHEREOF, the parties have executed this Agreement as of the date first above written.

|

“DEBTOR”

Global

|

|

“ASSUMPTOR”

Curadis GmbH

|

|

By: |

|

By: |

|

By:

AGREEMENT

THIS AGREEMENT (the “Agreement”) is made as of December 11th, 2009 by and among Marc A. Kessemeier, An der Rothalde 9/1, 79312 Emmendingen, Germany (“Creditor”), Global Clean Energy Holdings, Inc., a Utah corporation formerky known as Medical Discoveries, Inc. (“Debtor”), and Curadis GmbH, a company existing under the laws of the Federal Republic of Germany, Henkestr. 91, 91052 Erlangen, Germany (“Assumptor”), with reference to the following facts:

WHEREAS, Debtor and Creditor are parties to that certain Consultancy Agreement, dated March, 2005 (the “Kesseneier Contract”);

WHEREAS, Debtor and Assumptor are parties to a certain Sale and Purchase Agreement, dated as of November 16, 2009, (the “Purchase Agreement”); and

WHEREAS, in connection with the transactions contemplated by the Purchase Agreement, Debtor desires to transfer to Assumptor any and all right, title and interest it may have in, to and under the Kessemeier Contract, and Assumptor desires to assume the Debtor’s obligations under the Kessemeier Contract, as stipulated in Sec. 2 and 3 below; and

WHEREAS, Creditor is willing to (i) consent tot eh transfer of the benefits of Kessemeier Contract to the Assumptor, and (ii) release the Debtor from its obligation and the Debt under the Kessemeier Contract.