OFFICE LEASE

ADLER REALTY INVESTMENTS, INC.

100 W, BROADWAY

DANARI BROADWAY, LLC

a Delaware Limited Liability Company,

as Landlord,

and

GLOBAL CLEAN ENERGY HOLDINGS, INC,: a Utah Corporation,

as Tenant.

|

ARTICLE 1

|

PREMISES, BUILDING, PROJECT, AND COMMON AREAS.

|

1

|

|

ARTICLE 2

|

LEASE TERM[[; OPTION TERM]]

|

1

|

|

ARTICLE 3

|

BASE RENT

|

2

|

|

ARTICLE 4

|

ADDITIONAL RENT

|

3

|

|

ARTICLE 5

|

USE OF PREMISES

|

8

|

|

ARTICLE 6

|

SERVICES AND UTILITIES

|

9

|

|

ARTICLE 7

|

REPAIRS

|

11

|

|

ARTICLE 8

|

ADDITIONS AND ALTERATIONS

|

11

|

|

ARTICLE 9

|

COVENANT AGAINST LIENS

|

11

|

|

ARTICLE 10

|

INSURANCE

|

12

|

|

ARTICLE 11

|

DAMAGE AND DESTRUCTION

|

13

|

|

ARTICLE 12

|

NONWAIVER

|

14

|

|

ARTICLE 13

|

CONDEMNATION

|

14

|

|

ARTICLE 14

|

ASSIGNMENT AND SUBLETTING

|

14

|

|

ARTICLE 15

|

OWNERSHIP AND REMOVAL OF TRADE FIXTURES

|

16

|

|

ARTICLE 16

|

HOLDING OVER

|

16

|

|

ARTICLE 17

|

ESTOPPEL CERTIFICATES

|

17

|

|

ARTICLE 18

|

SUBORDINATION

|

17

|

|

ARTICLE 19

|

DEFAULTS; REMEDIES

|

18

|

|

ARTICLE 20

|

FORCE MAJEURE

|

19

|

|

ARTICLE 21

|

SECURITY DEPOSIT

|

19

|

|

ARTICLE 22

|

SUBSTITUTION OF OTHER PREMISES

|

19

|

|

ARTICLE 23

|

SIGNS

|

20

|

|

ARTICLE 24

|

COMPLIANCE WITH LAW

|

20

|

|

ARTICLE 25

|

LATE CHARGES

|

20

|

|

ARTICLE 26

|

LANDLORD'S RIGHT TO CURE DEFAULT; PAYMENTS BY TENANT .

|

20

|

|

ARTICLE 27

|

ENTRY BY LANDLORD..

|

21

|

|

ARTICLE 28

|

TENANT PARKING

|

21

|

|

ARTICLE 29

|

MISCELLANEOUS PROVISIONS

|

21

|

|

INDEX

|

|

|

Pagels1

|

|

|

Accountant

|

8

|

|

AdditionalNotice

|

9

|

|

AdditionalRent

|

4

|

|

Applicable Laws

|

17

|

|

Bank Prime Loan

|

17

|

|

Base Building

|

10

|

|

Base Rent

|

3

|

|

Base Year

|

4

|

|

bona-fide third-party offer

|

1

|

|

Brokers

|

19

|

|

Building

|

|

|

Building Common Areas,

|

|

|

Building Common Areas

|

|

|

CC&Rs

|

8

|

|

Control,

|

14

|

|

Direct Expenses

|

4

|

|

Eligibility Period

|

9

|

|

Estimate

|

7

|

|

Estimate Statement

|

7

|

|

Estimated Excess

|

7

|

|

Excess

|

7

|

|

Exercise Notice

|

3

|

|

Expense Year

|

4

|

|

First Refusal Notice

|

1

|

|

First Refusal Space

|

|

|

First Refusal Space Amendment

|

2

|

|

First Refusal Space Lease

|

2

|

|

First Refusal Space Rent

|

2

|

|

Force Majeure

|

16

|

|

Guarantor

|

21

|

|

HVAC

|

8

|

|

Initial Notice

|

9

|

|

Intent Notice

|

3

|

|

Interest Rate

|

17

|

|

Landlord

|

iii

|

|

Landlord Default

|

9

|

|

Landlord Parties

|

10

|

|

Lease

|

iii

|

|

Lease Commencement Date

|

2

|

|

Lease Expiration Date

|

2

|

|

Lease Term

|

2

|

|

Lease Year

|

2

|

|

Lines

|

20

|

|

Operating Expenses,

|

4

|

|

Option Rent

|

3

|

|

Option Rent Notice

|

3

|

|

Option Term

|

2

|

|

Original Tenant

|

1

|

|

Other Improvements

|

21

|

|

Permitted Transferee.

|

14

|

|

Permitted Use

|

iv

|

|

Premises

|

1

|

|

Project Common Areas

|

1

|

|

Project Common Areas,

|

1

|

|

Proposition 13

|

6

|

|

Renovations

|

20

|

|

Rent Abatement

|

4

|

|

Rent Abatement Period

|

4

|

|

Rent

|

4

|

|

Review Period

|

8

|

|

Rules and Regulations

|

8

|

|

Security Deposit

|

16

|

|

Signage

|

16

|

|

Statement

|

7

|

|

Summary

|

iii

|

|

Superior Right Holders

|

2

|

|

Tax Expenses

|

6

|

|

TCCs

|

1

|

|

Tenant

|

iii

|

|

Tenant Parties

|

it

|

|

Tenant Work Letter

|

1

|

|

Tenant's Share

|

7

|

| Termination Date |

3 |

| Termination Fee |

3 |

| Termination Notice |

3 |

|

Third Party Lease

|

2 |

| Transfer Premium |

13 |

100 W. BROADWAY

OFFICE LEASE

This Office Lease (the 'Lease"), dated as of the date set forth in Section 1 of the Summary of Basic Lease Information (the "Summary"), below, is made by and between DANARI BROADWAY, LLC, a Delaware Limited Liability Company ("Landlord"), and GLOBAL CLEAN ENERGY HOLDINGS, INC., a Utah corporation ("Tenant").

SUMMARY OF BASIC LEASE INFORMATION

TERMS Of DESCRIPTION

1. Date: May 24, 2010

2. Premises:

2.2 Premises:

2.3 Project:

|

That certain SIX (6)-story office building (the "Building") containing 194,184 rentable square feet of space and located at 100 W. BROADWAY, LONG BEACH, CA 90802.

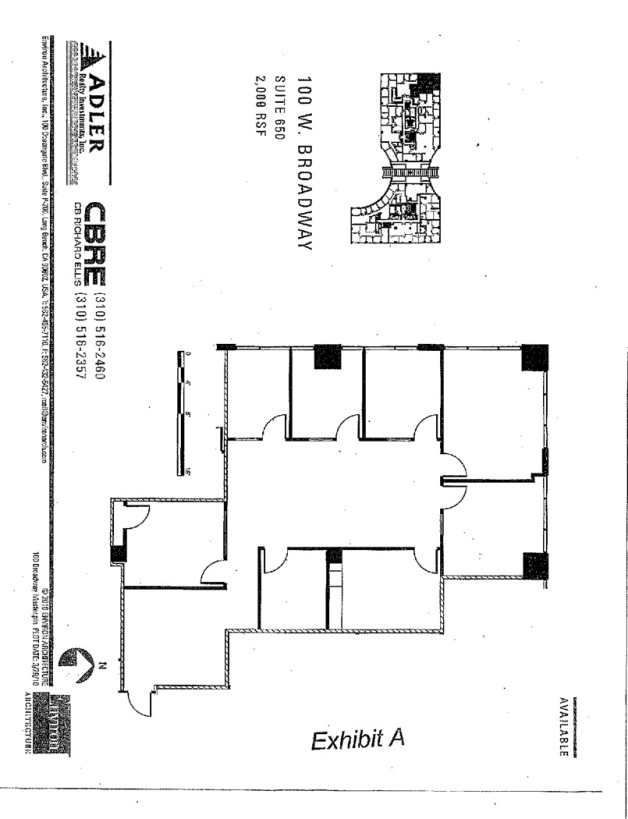

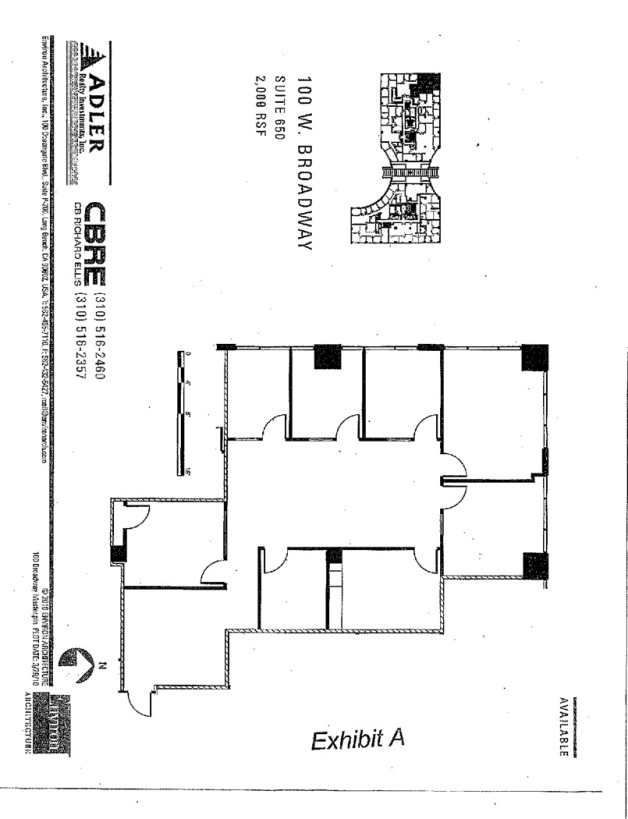

2000 rentable square feet of space located on the Sixth (6th) floor of the Building and commonly known as Suite 650, as further set forth in Exhibit A to the Office Lease.

The Building is part of a ONE-building office project known as "100 W. Broadway," as further set forth in Section 1 1,2 of this Lease.

|

3.1 Length of Term:

3.2 Lease Commencement Date:

3.3 Lease Expiration Date:

3.4 Option Term(s):

4. Base Rent (Article 3):

|

Two (2) years and Two (2) months.

Twenty-Six (26) months from the Lease Commencement Date, which is anticipated to be August 31, 2012.

One (1) three (3)-year option(s) to renew, as more particularly set forth in Section 2.2 of this Lease.

|

|

Base Rent*

|

Annual |

Monthly

Installment

of Base Rent*

|

Annual

Rental Rate

per Rentable

Square Foot*

|

| |

$ 3,400.00 |

$ 3,400.00 |

$1.70 |

| 2 — 3 |

0.00 |

$0.00 |

$0.00 |

| 4-12 |

$30,600.00 |

$3,400.00 |

$1.70 |

| 13 - 26 |

$49,000.00 |

$3,500.00 |

$1.75 |

The initial Annual Base Rent (and Monthly Installment of Base Rent) was calculated by multiplying the initial Monthly Rental Rate per Rentable Square Foot by the number of rentable square feet of space in the Premises.

6. Tenant's Share (Article 4):

|

Approximately 1.03%.

|

| 7. Permitted Use (Article 5): |

Tenant shall use the Premises solely for general office use and uses incidental thereto (the "Permitted Use"); provided, however, that notwithstanding anything to the contrary set forth hereinabove, and as more particularly set forth in the Lease, Tenant shall be responsible for operating and maintaining the Premises pursuant to, and in no event may Tenant's Permitted Use violate, (A) Landlords "Rules and Regulations," as that term is set forth in Article 5 of this Lease, (B) all "Applicable Laws," as that term is set forth in Article 24 of this Lease, (C) all applicable zoning, building codes and any "CC&Rs," as that term is set forth in Article 5 of this Lease, and (D) the character of the Project as a first-class office building Project.

|

8. Security Deposit (Article 21):

|

$ 3,500.00.

|

9. Parking Passes Ratio (Article 28):

|

Three (3) unreserved parking spaces for every 1,000 rentable square feet of the Premises. The current rates for parking are $65.00 per single unreserved pass per month and $110.00 per single reserved pass per month.

|

|

10. Address of Tenant (Section 29.11):

|

6033 W. Century Boulevard Suite 895 Los Angeles, CA 90045

Attention: Bruce Nelson, CFO

(Prior to Lease Commencement Date) and

100 W. Broadway, Suite 650Long Beach, CA 90802

Attention: Bruce Nelson, CFO

(Mier Lease Commencement Date)

|

|

11. Address of Landlord (Section 29.12):

12. Broker(s) (Section 29.10):

Representing Tenant:

Tom Sheets, Cushman & Wakefield 3760 Kilroy Airport Way, Suite 250 Long Beach, CA 90806

|

DANARI BROADWAY, LLC, A DELAWARE LIMITED LIABILITY COMPANY

do Adler Realty Investments, Inc.

20951 Burbank Blvd., Suite B

Woodland Hills, CA 91367

Attention: Asset Management

Representing Landlord:

Phil Brodkin, CBRE

990 West 190th Street, Suite 100 Torrance, CA 90502-1025

Landlord, at Landlord's sole cost and expense, shall install a sink and lower cabinets (not to exceed six (6) feet) in Premises in mutually agreeable location.

|

|

13.Tenant Improvement Allowance:

(Exhibit B):

|

ARTICLE 1

PREMISES, BUILDING, PROJECT, AND COMMON AREAS

1.1 Premises, Building, Project and Common Areas.

1.1.1 The Premises. Landlord hereby leases to Tenant and Tenant hereby leases from Landlord the premises set forth in Section 2.2 of the Summary (the "Premises"). The outline of the Premises is set forth in Exhibit A attached hereto and each floor or floors of the Premises has the number of rentable square feet as set forth in Section 2.2 of the Summary. The parties hereto agree that the lease of the Premises is upon and subject to the terms, covenants and conditions (the "TCCs") herein set forth, and Tenant covenants as a material part of the consideration for this Lease to keep and perform each and all of such TCCs by it to be kept and performed and that this Lease is made upon the condition of such performance. The parties hereto hereby acknowledge that the purpose of Exhibit A is to show the approximate location of the Premises in the "Building," as that term is defined in Section 1.1.2, below, only, and such exhibit is not meant to constitute an agreement, representation or warranty as to the construction of the Premises, the precise area thereof or the specific location of the "Common Areas," as that term is defined in Section 1.1.3, below, or the elements thereof or of the accessways to the Premises or the "Project," as that term is defined in Section 1.1,2, below. Except as specifically set forth in this Lease , Landlord shall not be obligated to provide or pay for any improvement work or services related to the improvement of the Premises. Tenant also acknowledges that neither Landlord nor any agent of Landlord has made any representation or warranty regarding the condition of the Premises, the Building or the Project or with respect to the suitability of any of the foregoing for the conduct of Tenant's business, except as specifically set forth in this Lease. The taking of possession of the Premises by Tenant shall conclusively establish that the Premises and the Building were at such time in good and sanitary order, condition and repair.

1.1.2The Building and The Project. The Premises are a part of the building set forth in Section 2.1 of the Summary (the "Building"). The Building is part of an office project known as "100 West Broadway." The term "Project," as used in this Lease, shall mean (i) the Building and the Common Areas, (ii) the land (which is improved with landscaping, parking facilities and other improvements) upon which the Building and the Common Areas are located.

1.1.3 Common Areas. Tenant shall have the non-exclusive right to use in common with other tenants in the Project, and subject to the rules and regulations referred to in Article 5 of this Lease, those portions of the Project which are provided, from time to time, for use in common by Landlord, Tenant and any other tenants of the Project (such areas, together with such other portions of the Project designated by Landlord, in its discretion, including certain areas designated for the exclusive use of certain tenants, or to be shared by Landlord and certain tenants, are collectively referred to herein as the "Common Areas"). The Common Areas shall consist of the "Project Common Areas" and the "Building Common Areas." The term "Project Common Areas," as used in this Lease, shall mean the portion of the Project designated as such by Landlord. The term "Building Common Areas," as used in this Lease, shall mean the portions of the Common Areas located within the Building designated as such by Landlord. The manner in which the Common Areas are maintained and operated shall be at the sole discretion of Landlord and the use thereof shall be subject to such rules, regulations and restrictions as Landlord may make from time to time, provided that such rules, regulations and restrictions do not unreasonably interfere with the rights granted to Tenant under this Lease and the permitted use granted under Section 5.1, below. Landlord reserves the right to close temporarily, make alterations or additions to, or change the location of elements of the Project and the Common Areas; provided that no such changes shall be permitted which materially reduce Tenant's rights or access hereunder. Except when and where Tenant's right of access is specifically excluded in this Lease, Tenant shall have the right of access to the Premises, the Building, and the Project parking facility twenty-four (24) hours per day, seven (7) days per week during the "Lease Term," as that term is defined in Article 2, below,

1.2 Stipulation of Rentable Square Feet of Premises. For purposes of this Lease, the "rentable square feet" of the Building and Premises shall be deemed as set forth in Section 2.1 and Section 2.2 of the Summary, respectively.

ARTICLE 2

LEASE TERM; OPTION TERM

2.1 Initial Lease Term. The TCCs and provisions of this Lease shall be effective as of the date of this Lease. The term of this Lease (the "Lease Term") shall be as set forth in Section 3.1 of the Summary, shall commence on the date set forth in Section 3.2 of the Summary (the "Lease Commencement Date"), and shall terminate on the date set forth in Section 3.3 of the Summary (the "Lease Expiration Date") unless this Lease is sooner terminated as hereinafter provided. For purposes of this Lease, the term "Lease Year" shall mean each consecutive twelve (12) month period during the Lease Term provided, however, that the first Lease Year shall commence on the Lease Commencement Date and end on the last day of the month in which the first anniversary of the Lease Commencement Date occurs, and the second and each succeeding Lease Year shall commence on the first day of the next calendar month,

2.2Option Term,

2.2.1 Option RiEht. Landlord hereby grants the Original Tenant and any Permitted Transferee, one (1) option to extend the Lease Term for the entire Premises by a period of three (3) years (the "Option Term"). Such option shall be exercisable only by written notice delivered by Tenant to Landlord as provided below, provided that, as of the date of delivery of such notice, (i) Tenant is not then in default under this Lease (beyond any applicable notice and cure periods), (ii) Tenant has not been in default under this Lease (beyond any applicable notice and cure periods) more than once during the prior twelve (12) month period, (iii) Tenant has not been in default under this Lease (beyond any applicable notice and cure periods) more than three (3) times during the Lease Term, and (iv) Tenant's financial condition has not suffered a material, adverse change during the immediately preceding twenty-four (24) month period. Upon the proper exercise of such option to extend, and provided that, as of the end of the initial Lease Term, (A) Tenant is not in default under this Lease (beyond any applicable notice and cure periods), (B) Tenant has not been in default under this Lease (beyond any applicable notice and cure periods) more than once during the prior twelve(12) month period, (C) Tenant has not been in default under this Lease (beyond any applicable notice and cure periods) more than three (3) times during the Lease Term, and (D) Tenant's financial condition has not suffered a material, adverse change during the immediately preceding twenty-four (24) month period, then the Lease Term, as it applies to the entire Premises, shall be extended for a period of five (5) years. The rights contained in this Section 2.2 shall only be exercised by the Original Tenant or its Affiliate (and not any other assignee, sublessee or other transferee of the Original Tenant's interest in this Lease) if Original Tenant and/or its Permitted Transferee is in occupancy of the entire then-existing Premises.

2.2.2 Option Rent, The "Rent," as that term is defined in Section 4.1 of this Lease, payable by Tenant during the Option Term (the "Option Rent") shall be equal to the rent, including all escalations, at which tenants, as of the commencement of the Option Term, are leasing non-sublease, non-encumbered, non-equity space comparable in size, location and quality to the Premises for a term of three (3) years, which comparable space is located in the downtown Long Beach office market, taking into consideration only the following concessions: (i) rental abatement concessions, if any, being granted such tenants in connection with such comparable space, and (ii) tenant improvements or allowances provided or to be provided for such comparable space, taking into account, and deducting the value of, the existing improvements in the Premises, such value to be based upon the age, quality and layout of the improvements and the extent to which the same could be utilized by Tenant based upon the fact that the precise tenant improvements existing in the Premises are specifically suitable to Tenant.

2.2.3 Exercise of Option. The option contained in this Section 2.2 shall be exercised by Tenant, if at all, only in the manner set forth in this Section 2.2.3. Tenant shall deliver written notice (the "Intent Notice") to Landlord not more than twelve (12) months nor less than six (6) months prior to the expiration of the initial Lease Term, stating that Tenant is interested in exercising its option. On or before the date which is the later to occur of (i) thirty (30) days following its receipt of such Intent Notice, or (ii) the date which is five (5) months prior to the expiration of the initial Lease Term, Landlord shall deliver to Tenant a written notice (the "Option Rent Notice") to Tenant, setting forth Landlord's determination of the Option Rent. Within ten (10) business days of its receipt of the Option Rent Notice, Tenant may, at its option, either (A) deliver written notice (the "Exercise Notice") to Landlord, which Exercise Notice shall state that Tenant is exercising its option and excepting the Option Rent, or (B) otherwise elect not to so exercise such option. If Tenant does not timely and affirmatively exercise the option contained in this Section 2.2 by delivering the Exercise Notice pursuant to the TCCs of the foregoing sentence, Tenant shall be deemed not to have exercised such option, and the option shall terminate and be of no further force or effect.

ARTICLE 3

BASE RENT

3.1 In General. Tenant shall pay, without prior notice or demand, to Landlord or Landlord's agent at the management office of the Project, or, at Landlord's option, at such other place as Landlord may from time to time designate in writing, by a check for currency which, at the time of payment, is legal tender for private or public debts in the United States of America, base rent ("Base Rent") as set forth in Section 4 of the Summary, payable in equal monthly installments as set forth in Section 4 of the Summary in advance on or before the first day of each and every calendar month during the Lease Term, without any setoff or deduction whatsoever. The Base Rent for the first full month of the Lease Term which occurs after the expiration of any free rent period shall be paid at the time of Tenant's execution of this Lease. If any payment of Rent is for a period which is shorter than one month, the Rent for any such fractional month shall accrue on a daily basis during such fractional month and shall total an amount equal to the product of (1) a fraction, the numerator of which is the number of days in such fractional month and the denominator of which is the actual number of days occurring in such calendar month, and (ii) the then-applicable Monthly Installment of Base Rent. All other payments or adjustments required to be made under the TCCs of this Lease that require proration on a time basis shall be prorated on the same basis.

3.2 Rent Abatement. Provided that the Tenant is not then in default of the Lease (as hereby amended) and is then in occupancy of the entire Premises, then during the period beginning on second (2'd) month of the Lease Term and ending after the third (3`d) month of the Lease Term (the "Rent Abatement Period"), Tenant shall not be obligated to pay any Base Rent otherwise attributable to the Premises for such Rent Abatement Period (the "Rent Abatement"). Tenant acknowledges and agrees that during such Rent Abatement Period, such abatement of Base Rent shall have no effect on the calculation of any future increases in Base Rent, Operating Costs or Landlord's Taxes payable by Tenant pursuant to the terms of this Lease, which increases shall be calculated without regard to such abatement of Base Rent. The foregoing Rent Abatement has been granted to Tenant as additional consideration for entering into this Agreement, and for agreeing to pay the rent and performing the terms and conditions otherwise required under the Lease, as amended. If Tenant shall be in economic default or material non-economic default under the Lease and shall fail to cure such economic default or material non-economic default within notice and cure period, if any, permitted for cure pursuant to the Lease, then Landlord may at its option, by notice to Tenant, elect, in addition to any other remedies Landlord may have under the Lease, one or both of the following remedies: (i) that Tenant shall immediately become obligated to pay to Landlord all Base Rent abated hereunder during the Rent Abatement Period, with interest as provided pursuant to the Lease from the date such Base Rent would have otherwise been due but for the abatement provided herein, or (ii) that the dollar amount of the unapplied portion of the Rent Abatement as of such default shall be converted to a credit to be applied to the Base Rent applicable to the Premises at the end of the Second Extended Term and Tenant shall immediately be obligated to begin paying Base Rent for the Premises in full.

ARTICLE 4

ADDITIONAL RENT

4.1General Terms. In addition to paying the Base Rent specified in Article 3 of this Lease, Tenant shall pay "Tenant's Share" of the annual "Direct Expenses," as those terms are defined in Sections 4.2.6 and 4.2.2 of this Lease, respectively, which are in excess of the amount of Direct Expenses applicable to the "Base Year," as that term is defined in Section 4.2.1, below; provided, however, that in no event shall any decrease in Direct Expenses for any Expense Year below Direct Expenses for the Base Year entitle Tenant to any decrease in Base Rent or any credit against sums due under this Lease. Such payments by Tenant, together with any and all other amounts payable by Tenant to Landlord pursuant to the TCCs of this Lease, are hereinafter collectively referred to as the "Additional Rent," and the Base Rent and the Additional Rent are herein collectively referred to as "Rent." All amounts due under this Article 4 as Additional Rent shall be payable for the same periods and in the same manner as the Base Rent; provided, however, the parties hereby acknowledge that the first monthly installment of Tenant's Share of any "Estimated Excess," as that term is set forth in, and pursuant to the terms and conditions of, Section 4.4.2 of this Lease, shall first be due and payable for the calendar month occurring immediately following the expiration of the Base Year. Without limitation on other obligations of Tenant which survive the expiration of the Lease Term, the obligations of Tenant to pay the Additional Rent provided for in this Article 4 shall survive the expiration of the Lease Term.

4.2Definitions of Key Terms Relating to Additional Rent. As used in this Article 4, the following terms

shall have the meanings hereinafter set forth:

4.2.1"Base Year" shall mean the period set forth in Section 5 of the Summary.

4.2.2"Direct Expenses" shall mean "Operating Expenses" and "Tax Expenses."

4.2.3"Expense Year" shall mean each calendar year in which any portion of the Lease Term falls,

through and including the calendar year in which the Lease Term expires, provided that Landlord, upon notice to Tenant, may change the Expense Year from time to time to any other twelve (12) consecutive month period, and, in the event of any such change, Tenant's Share of Direct Expenses shall be equitably adjusted for any Expense Year involved in any such change.

4.2.4"Operating Expenses" shall mean all expenses, costs and amounts of every kind and nature which Landlord pays or accrues during any Expense Year because of or in connection with the ownership, management,

maintenance, security, repair, replacement, restoration or operation of the Project, or any portion thereof, in accordance with sound real estate management and accounting principles, consistently applied. Without limiting the generality of the foregoing, Operating Expenses shall specifically include any and all of the following: (i) the cost of supplying all utilities (other than the cost of electricity, the payment for which shall be made in accordance with the TCCs of Section 6.1.2 of this Lease), the cost of operating, repairing, maintaining, and renovating the utility, telephone, mechanical, sanitary, storm drainage, and elevator systems, and the cost of maintenance and service contracts in connection therewith; (ii) the cost of licenses, certificates, permits and inspections and the cost of contesting any governmental enactments which may affect Operating Expenses, and the costs incurred in connection with a governmentally mandated transportation system management program or similar program; (iii) the cost of all insurance carried by Landlord in connection with the Project; (iv) the cost of landscaping, relamping, and all supplies, tools, equipment and materials used in the operation, repair and maintenance of the Project, or any portion thereof; (v) costs incurred in connection with the parking areas servicing the Project; (vi) fees and other costs, including management fees, consulting fees, legal fees and accounting fees, of all contractors and consultants in connection with the management, operation, maintenance and repair of the Project;

(vii) payments under any equipment rental agreements and the fair rental value of any management office .space;

(viii) wages, salaries and other compensation and benefits, including taxes levied thereon, of all persons (other than persons generally considered to be higher in rank than the position of Project manager) engaged in the operation, maintenance and security of the Project; (ix) costs under any instrument pertaining to the sharing of costs by the Project; (x) operation, repair, maintenance and replacement of all systems and equipment and components thereof of the Building; (xi) the cost of janitorial services to the Common Areas and the cost of alarm, security and other services, replacement of wall and floor coverings, ceiling tiles and fixtures in common areas, maintenance and replacement of curbs and walkways, repair to roofs and re-roofing; (xii) amortization of the cost of acquiring or the rental expense of personal property used in the maintenance, operation and repair of the Project, or any portion thereof (which amortization calculation shall include interest at the "Interest Rate," as that term is set forth in Article 25 of this Lease); (xiii) the cost of capital improvements or other costs incurred in connection with the Project (A) which are intended to effect economies in the operation or maintenance of the Project, or any portion thereof, (B) that are required to comply with present or anticipated conservation programs, (C) which are replacements or modifications of nonstructural items located in the Common Areas required to keep the Common Areas in good order or condition, or (D) that are required under any governmental law or regulation by a federal, state or local governmental agency, except for capital repairs, replacements or other improvements to remedy a condition existing prior to the Lease Commencement Date which an applicable governmental authority, if it had knowledge of such condition prior to the Lease Commencement Date, would have then required to be remedied pursuant to then-current governmental laws or regulations in their form existing as of the Lease Commencement Date and pursuant to the then-current interpretation of such governmental laws or regulations by the applicable governmental authority as of the Lease Commencement Date; provided, however, that any capital expenditure shall be shall be amortized with interest at the Interest Rate over the shorter of (X) seven (7) years, or (Y) its useful life as Landlord shall reasonably determine in accordance with sound real estate management and accounting principles; (xiv) costs, fees, charges or assessments imposed by, or resulting from any mandate imposed on Landlord by, any federal, state or local government for fire and police protection, trash removal, community services, or other services which do not constitute "Tax Expenses" as that term is defined in Section

4.2.5, below; and (xv) payments under any easement, license, operating agreement, declaration, restrictive covenant, or instrument pertaining to the sharing of costs by the Building.

Notwithstanding the foregoing, for purposes of this Lease, Operating Expenses shall not, however, include:

(a) costs, including marketing costs, legal fees, space planners' fees, advertising and promotional expenses, and brokerage fees incurred in connection with the original construction or development, or original or future leasing of the Project, and costs, including permit, license and inspection costs, incurred with respect to the installation of tenant improvements made for new tenants initially occupying space in the Project after the Lease Commencement Date or incurred in renovating or otherwise improving, decorating, painting or redecorating vacant space for tenants or other occupants of the Project (excluding, however, such costs relating to any common areas of the Project or parking facilities);

(b) except as set forth in items (xii), (xiii), and (xiv) above, depreciation, interest and principal payments on mortgages and other debt costs, if any, penalties and interest;

(c) costs for which the Landlord is reimbursed by any tenant or occupant of the Project or by insurance by its carrier or any tenant's carrier or by anyone else, and electric power costs for which any tenant directly contracts with the local public service company;

(d) any bad debt loss, rent loss, or reserves for bad debts or rent loss;

(e) costs associated with the operation of the business of the partnership or entity which constitutes the Landlord, as the same are distinguished from the costs of operation of the Project (which shall specifically

include, but not be limited to, accounting costs associated with the operation of the Project). Costs associated with the operation of the business of the partnership or entity which constitutes the Landlord include costs of partnership accounting and legal matters, costs of defending any lawsuits with any mortgagee (except as the actions of the Tenant may be in issue), costs of selling, syndicating, financing, mortgaging or hypothecating any of the Landlord's interest in the Project, and costs incurred in connection with any disputes between Landlord and its employees, between Landlord and Project management, or between Landlord and other tenants or occupants, and Landlord's general corporate overhead and general and administrative expenses;

(f) the wages and benefits of any employee who does not devote substantially all of his or her employed time to the Project unless such wages and benefits are prorated to reflect time spent on operating and managing the Project vis-a-vis time spent on matters unrelated to operating and managing the Project; provided, that in no event shall Operating Expenses for purposes of this Lease include wages and/or benefits attributable to personnel above the level of Project manager;

(g) amount paid as ground rental for the Project by the Landlord;

(h) overhead and profit increment paid to the Landlord or to subsidiaries or affiliates of the Landlord for services in the Project to the extent the same exceeds the costs of such services rendered by qualified, first-class unaffiliated third parties on a competitive basis;

(1) any compensation paid to clerks, attendants or other persons in commercial concessions operated by the Landlord, provided that any compensation paid to any concierge at the Project shall be includable as an Operating Expense; rentals and other related expenses incurred in leasing air conditioning systems, elevators or other equipment which if purchased the cost of which would be excluded from Operating Expenses as a capital cost, except equipment not affixed to the Project which is used in providing janitorial services to the Common Area (or similar services to the Project) and, further excepting from this exclusion such equipment rented or leased to remedy or ameliorate an emergency condition in the Project;

(k) all items and services for which Tenant or any other tenant in the Project reimburses Landlord or which Landlord provides selectively to one or more tenants (other than Tenant) without reimbursement;

(I) costs, other than those incurred in ordinary maintenance and repair, for sculpture, paintings, fountains or other objects of art;

(in) any costs expressly excluded from Operating Expenses elsewhere in this Lease;

(n) rent for any office space occupied by Project management personnel to the extent the size or rental rate of such office space exceeds the size or fair market rental value of office space occupied by management personnel of the Comparable Buildings in the vicinity of the Building, with adjustment where appropriate for the size of the applicable project;

(o) costs arising from the gross negligence or willful misconduct of Landlord or its agents, employees, vendors, contractors, or providers of materials or services; and

(p) costs incurred to comply with laws relating to the removal of hazardous material (as defined under applicable law) which was in existence in the Building or on the Project prior to the Lease Commencement Date, and was of such a nature that a federal, State or municipal governmental authority, if it had then had knowledge of the presence of such hazardous material, in the state, and under the conditions that it then existed in the Building or on the Project, would have then required the removal of such hazardous material or other remedial or containment action with respect thereto; and costs incurred to remove, remedy, contain, or treat hazardous material, which hazardous material is brought into the Building or onto the Project after the date hereof by Landlord or any other tenant of the Project and is of such a nature, at that time, that a federal, State or municipal governmental authority, if it had then had knowledge of the presence of such hazardous material, in the state, and under the conditions, that it then exists in the Building or on the Project, would have then required the removal of such hazardous material or other remedial or containment action with respect thereto.

If Landlord is not furnishing any particular work or service (the cost of which, if performed by Landlord, would be included in Operating Expenses) to a tenant who has undertaken to perform such work or service in lieu of the performance thereof by Landlord, Operating Expenses shall be deemed to be increased by an amount equal to the additional Operating Expenses which would reasonably have been incurred during such period by Landlord if it had at its own expense furnished such work or service to such tenant. If the Project is not at least ninety-five percent (95%) occupied during all or a portion of the Base Year or any Expense Year, Landlord may elect to make an appropriate adjustment to the components of

Operating Expenses for such year to determine the amount of Operating Expenses that would have been incurred had the Project been ninety-five percent (95%) occupied; and the amount so determined shall be deemed to have been the amount of Operating Expenses for such year. Operating Expenses for the Base Year shall not include market-wide cost increases due to extraordinary circumstances, including, but not limited to, Force Majeure, boycotts, strikes, conservation surcharges, embargoes or shortages, or amortized costs relating to capital improvements. In no event shall the components of Direct Expenses for any Expense Year related to Project utility, services, or insurance costs be less than the components of Direct Expenses related to Project utility, services, or insurance costs in the Base Year. Landlord shall not (i) make a profit by charging items to Operating Expenses that are otherwise also charged separately to others and (ii) subject to Landlord's right to adjust the components of Operating Expenses described above in this paragraph, collect Operating Expenses from Tenant and all other tenants in the Building in an amount in excess of what Landlord incurs for the items included in Operating Expenses.

4.2.5Taxes.

4.2.5.1"Tax Expenses" shall mean all federal, state, county, or local governmental or

municipal taxes, fees, charges or other impositions of every kind and nature, whether general, special, ordinary or extraordinary, (including, without limitation, real estate taxes, general and special assessments, transit taxes, leasehold taxes or taxes based upon the receipt of rent, including gross receipts or sales taxes applicable to the receipt of rent, unless required to be paid by Tenant, personal property taxes imposed upon the fixtures, machinery, equipment, apparatus, systems and equipment, appurtenances, furniture and other personal property used in connection with the Project, or any portion thereof), which shall be paid or accrued during any Expense Year (without regard to any different fiscal year used by such governmental or municipal authority) because of or in connection with the ownership, leasing and operation of the Project, or any portion thereof.

4.2.5.2Tax Expenses shall include, without limitation: (i) Any tax on the rent, right to rent or

other income from the Project, or any portion thereof, or as against the business of leasing the Project, or any portion thereof; (ii) Any assessment, tax, fee, levy or charge in addition to, or in substitution, partially or totally, of any assessment, tax, fee, levy or charge previously included within the definition of real property tax. Tax Expenses shall also include any governmental or private assessments or the Project's contribution towards a governmental or private cost-sharing agreement for the purpose of augmenting or improving the quality of services and amenities normally provided by governmental agencies; (iii) Any assessment, tax, fee, levy, or charge allocable to or measured by the area of the Premises or the Rent payable hereunder, including, without limitation, any business or gross income tax or excise tax with respect to the receipt of such rent, or upon or with respect to the possession, leasing, operating, management, maintenance, alteration, repair, use or occupancy by Tenant of the Premises, or any portion thereof; and (iv) Any assessment, tax, fee, levy or charge, upon this transaction or any document to which Tenant is a party, creating or transferring an interest or an estate in the Premises.

4.2.5.3Any costs and expenses (including, without limitation, reasonable attorneys' fees)

incurred in attempting to protest, reduce or minimize Tax Expenses shall be included in Tax Expenses in the Expense Year such expenses are paid. Except as set forth in Section 4,2,5,4, below, refunds of Tax Expenses shall be credited against Tax Expenses and refunded to Tenant regardless of when received, based on the Expense Year to which the refund is applicable, provided that in no event shall the amount to be refunded to Tenant for any such Expense Year exceed the total amount paid by Tenant as Additional Rent under this Article 4 for such Expense Year. If Tax Expenses for any period during the Lease Term or any extension thereof are increased after payment thereof for any reason, including, without limitation, error or reassessment by applicable governmental or municipal authorities, Tenant shall pay Landlord upon demand Tenant's Share of any such increased Tax Expenses included by Landlord as Building Tax Expenses pursuant to the TCCs of this Lease. Notwithstanding anything to the contrary contained in this Section 4.2.8 (except as set forth in Section 4,2,8,1, above), there shall be excluded from Tax Expenses (i) all excess profits taxes, franchise taxes, gift taxes, capital stock taxes, inheritance and succession taxes, estate taxes, federal and state income taxes, and other taxes to the extent applicable to Landlord's general or net income (as opposed to rents, receipts or income attributable to operations at the Project), (ii) any items included as Operating Expenses, and (iii) any items paid by Tenant under Section 4.5 of this Lease.

4,2.5.4 Notwithstanding anything to the contrary set forth in this Lease, the amount of Tax Expenses for the Base Year and any Expense Year shall be calculated without taking into account any decreases in real estate taxes and, therefore, the Tax Expenses in the Base Year and/or an Expense Year may be greater than those actually incurred by Landlord, but shall, nonetheless, be the Tax Expenses due under this Lease; provided that (i) any costs and expenses incurred by Landlord in securing any Tax Expense reduction shall not be included in Direct Expenses for purposes of this Lease, and (ii) tax refunds shall not be deducted from Tax Expenses, but rather shall be the sole property of Landlord.

4.2.6"Tenant's Share" shall mean the percentage set forth in Section 6 of the Summary.

4.3Allocation of Direct Expenses. The parties acknowledge that the Building is a part of a multi-building project and that the costs and expenses incurred in connection with the Project (i.e. the Direct Expenses) should be shared between the tenants of the Building and the tenants of the other buildings in the Project. Accordingly, as set forth in Section 4.2 above, Direct Expenses (which consists of Operating Expenses and Tax Expenses) are determined annually for the Project as a whole, and a portion of the Direct Expenses, which portion shall be determined by Landlord on an equitable basis, shall be allocated to the tenants of the Building (as opposed to the tenants of any other buildings in the Project) and such portion shall be the Direct Expenses for purposes of this Lease. Such portion of Direct Expenses allocated to the tenants of the Building shall include all Direct Expenses attributable solely to the Building and an equitable portion of the Direct Expenses attributable to the Project as a whole.

4.4Calculation and Payment of Additional Rent. If for any Expense Year ending or commencing within the Lease Term, Tenant's Share of Direct Expenses for such Expense Year exceeds Tenant's Share of Direct Expenses applicable to the Base Year, then Tenant shall pay to Landlord, in the manner set forth in Section 4.4.1, below, and as Additional Rent, an amount equal to the excess (the "Excess").

4.4.1Statement of Actual Building Direct Expenses and Payment by Tenant. Landlord shall give to Tenant following the end of each Expense Year, a statement (the "Statement") which shall state in general major categories the Building Direct Expenses incurred or accrued for the Base Year or such preceding Expense Year, as applicable, and which shall indicate the amount of the Excess. Landlord shall use commercially reasonable efforts to deliver such Statement to Tenant on or before May 1 following the end of the Expense Year to which such Statement relates. Upon receipt of the Statement for each Expense Year commencing or ending during the Lease Term, if an Excess is present, Tenant shall pay, within thirty (30) days after receipt of the Statement, the full amount of the Excess for such Expense Year, less the amounts, if ally, paid during such Expense Year as "Estimated Excess," as that term is defined in Section 4.4.2, below, and if Tenant paid more as Estimated Excess than the actual Excess, Tenant shall receive a credit in the amount of Tenant's overpayment against Rent next due under this Lease. The failure of Landlord to timely furnish the Statement for any Expense Year shall not prejudice Landlord or Tenant from enforcing its rights under this Article 4. Even though the Lease Term has expired and Tenant has vacated the Premises, when the final determination is made of Tenant's Share of Building Direct Expenses for the Expense Year in which this Lease terminates, if an Excess is present, Tenant shall, within thirty (30) days after receipt of the Statement, pay to Landlord such amount, and if Tenant paid more as Estimated Excess than the actual Excess, Landlord shall, within thirty (30) days, deliver a check payable to Tenant in the amount of the overpayment. The provisions of this Section 4.4.1 shall survive the expiration or earlier termination of the Lease Term. Notwithstanding the immediately preceding sentence, Tenant shall not be responsible for Tenant's Share of any Building Direct Expenses attributable to any Expense Year which are first billed to Tenant more than two (2) calendar years after the Lease Expiration Date, provided, however, that Tenant shall nevertheless remain responsible for Tenant's Share of Direct Expenses levied by any governmental authority or by any public utility companies at any time following the Lease Expiration Date which are attributable to any Expense Year.

4.4.2Statement of Estimated Building Direct Expenses. In addition, Landlord shall give Tenant a yearly expense estimate statement (the "Estimate Statement") which shall set forth in general major categories Landlord's reasonable estimate (the "Estimate") of what the total amount of Building Direct Expenses for the then-current Expense Year shall be and the estimated excess (the "Estimated Excess") as calculated by comparing the Building Direct Expenses for such Expense Year, which shall be based upon the Estimate, to the amount of Building Direct Expenses for the Base Year. Landlord shall use commercially reasonable efforts to deliver such Estimate Statement to Tenant on or before May I following the end of the Expense Year to which such Estimate Statement relates. The failure of Landlord to timely furnish the Estimate Statement for any Expense Year shall not preclude Landlord from enforcing its rights to collect any Additional Rent under this Article 4, nor shall Landlord be prohibited from revising any Estimate Statement or Estimated Excess theretofore delivered to the .extent necessary. Thereafter, Tenant shall pay, within thirty (30) days after receipt of the Estimate Statement, a fraction of the Estimated Excess for the then-current Expense Year (reduced by any amounts paid pursuant to the second to last sentence of this Section 4.4.2). Such fraction shall have as its numerator the number of months which have elapsed in such current Expense Year, including the month of such payment, and twelve (12) as its denominator. Until a new Estimate Statement is furnished (which Landlord shall have the right to deliver to Tenant at any time), Tenant shall pay monthly, with the monthly Base Rent installments, an amount equal to one-twelfth (1/12) of the total Estimated Excess set forth in the previous Estimate Statement delivered by Landlord to Tenant. Throughout the Lease Term Landlord shall maintain books and records with respect to Building Direct Expenses in accordance with generally accepted real estate accounting and management practices, consistently applied.

4.5Taxes and Other Charges for Which Tenant Is Directly Responsible.

4.5.1Tenant shall be liable for and shall pay ten (10) days before delinquency, taxes levied against Tenant's equipment, furniture, fixtures and any other personal property located in or about the Premises. If any such taxes on Tenant's equipment, furniture, fixtures and any other personal property are levied against Landlord or Landlord's property or if the assessed value of Landlord's property is increased by the inclusion therein of a value placed upon such equipment, furniture, fixtures or any other personal property and if Landlord pays the taxes based upon such increased assessment, which Landlord shall have the right to do regardless of the validity thereof brit only under proper protest if requested by Tenant, Tenant shall upon demand repay to Landlord the taxes so levied against Landlord or the proportion of such taxes resulting from such increase in the assessment, as the case may be.

4.5.2 If the tenant improvements in the Premises, whether installed and/or paid for by Landlord or Tenant and whether or not affixed to the real property so as to become a part thereof, are assessed for real property tax purposes at a valuation higher than the valuation at which tenant improvements conforming to Landlord's "building standard" in other space in the Building are assessed, then the Tax Expenses levied against Landlord or the property by reason of such excess assessed valuation shall be deemed to be taxes levied against personal property of Tenant and shall be governed by the provisions of Section 4.5.1, above.

4.5.3 Notwithstanding any contrary provision herein, Tenant shall pay prior to delinquency any (i) rent tax or sales tax, service tax, transfer tax or value added tax, or any other applicable tax on the rent or services herein or otherwise respecting this Lease, (ii) taxes assessed upon or with respect to the possession, leasing, operation, management, maintenance, alteration, repair, use or occupancy by Tenant of the Premises or any portion of the Project, including the Project parking facility; or (iii) taxes assessed upon this transaction or any document to which Tenant is a party creating or transferring an interest or an estate in the Premises.

4,6 Landlord's Books and Records. Upon Tenant's written request given not more than ninety (90) daysafter Tenant's receipt of a Statement for a particular Expense Year, and provided that Tenant is not then in default under this Lease beyond the applicable cure period provided in this Lease, Landlord shall furnish Tenant with such reasonable supporting documentation in connection with said Building Direct Expenses as Tenant may reasonably request. Landlord shall provide said information to Tenant within sixty (60) days after Tenant's written request therefor. Within one hundred eighty (180) days after receipt of a Statement by Tenant (the "Review Period"), if Tenant disputes the amount of Additional Rent set forth in the Statement, an independent certified public accountant (which accountant (A) is a member of a nationally or regionally recognized accounting firm, and (B) is not working on a contingency fee basis), designated and paid for by Tenant, may, after reasonable notice to Landlord and at reasonable times, inspect Landlord's records with respect to the Statement at Landlord's offices, provided that Tenant is not then in default under this Lease (beyond any applicable notice and cure periods) and Tenant has paid all amounts required to be paid under the applicable Estimate Statement and Statement, as the case may be. In connection with such inspection, Tenant and Tenant's agents must agree in advance to follow Landlord's reasonable rules and procedures regarding inspections of Landlord's records, and shall execute a commercially reasonable confidentiality agreement regarding such inspection. Tenant's failure to dispute the amount of Additional Rent set forth in any Statement within the Review Period shall be deemed to be Tenant's approval of such Statement and Tenant, thereafter, waives the right or ability to dispute the amounts set forth in such Statement. If after such inspection, Tenant still disputes such Additional Rent, a determination as to the proper amount shall be made, at Tenant's expense, by an independent certified public accountant (the "Accountant") selected by Landlord and subject to Tenant's reasonable approval; provided that if such determination by the Accountant proves that Direct Expenses were overstated by more than five percent (5%), then the cost of the Accountant and the cost of such determination shall be paid for by Landlord. Tenant hereby acknowledges that Tenant's sole right to inspect Landlord's books and records and to contest the amount of Direct Expenses payable by Tenant shall be as set forth in this Section 4.6, and Tenant hereby waives any and all other rights pursuant to applicable law to inspect such books and records and/or to contest the amount of Direct Expenses payable by Tenant.

ARTICLE 5

USE OF PREMISES

Tenant shall use the Premises solely for the "Permitted Use," as that term is defined in Section 7 of the Summary, and Tenant shall not use or permit the Premises to be used for any other purpose or purposes whatsoever without the prior written consent of Landlord, which may be withheld in Landlord's sole and absolute discretion. Tenant covenants and agrees that it shall not use, or suffer or permit any person or persons to use, the Premises or any part thereof for any use or purpose contrary to the rules and regulations promulgated by Landlord from time to time ("Rules and Regulations"), or in violation of the laws of the United States of America, the State of California or the ordinances, regulations or requirements of the local municipal or county governing body or other lawful authorities having jurisdiction over the Building, or in a manner otherwise inconsistent with the character of the Project as a first-class office building Project. Tenant shall faithfully observe and comply with the Rules and Regulations, the current set of which (as of the date of this Lease) is

attached to this Lease as Exhibit D; provided, however, Landlord shall not enforce, change or modify the Rules and Regulations in a discriminatory manner and Landlord agrees that the Rules and Regulations shall not be unreasonably modified or enforced in a manner which will unreasonably interfere with the normal and customary conduct of Tenant's business.

ARTICLE 6

SERVICES AND UTILITIES

6.1 Standard Tenant Services. Landlord shall provide the following services and utilities.

6.1.1 Subject to reasonable change implemented by Landlord and all governmental rules, regulationsand guidelines applicable thereto, Landlord shall provide heating and all conditioning when necessary for normal comfort for normal office use in the Premises ("HVAC") from Monday through Friday from 8:00 a.m. to 7:00 p.m., and on Saturday from 8:00 a.m. to 1:00 p.m. (collectively, the "Building Hours"), except for the date of observation of locally and nationally recognized holidays (collectively, the "Holidays"). The daily time periods identified hereinabove are sometimes referred to as the "Business Hours." Landlord shall make available HVAC at other times at Tenant's expense, provided that such HVAC usage will be separately metered and billed to Tenant at the hourly rate charged by Landlord for after hours HVAC usage. Tenant shall install, operate and maintain, at its expense, such additions or modifications to HVAC Equipment as may be reasonably determined by Landlord to be necessary in order to maintain building HVAC standards or to correct temperature imbalance resulting from Tenant's installation and operation of lights, machines, computer or electronic data processing equipment or other special equipment or facilities placing a greater burden on HVAC Equipment than would general office use.

6.1.2 Landlord shall provide adequate electrical wiring and facilities and power for normal general office use as determined by Landlord. Tenant shall bear the cost of replacement of lamps, starters and ballasts for non-Building standard lighting fixtures within the Premises. Building standard electrical power to the Premises shall be sufficient for operation under normal business conditions of building standard office lighting (approximately 3 watts per square foot of Usable Area) and receptacles (approximately 1 watt per square foot of Usable Area), Tenant shall not install or use or permit installation or use in the Premises of any electronic data processing equipment, special lighting in excess of building standard office lighting, or any other item of electrical equipment which singly consumes more than 0.25 kilowatts per hour at rated capacity or requires a voltage other than 120 volts single phase without Landlord's prior written consent. In no event shall Tenant's use of electric current ever exceed the capacity of the Building standard feeders, risers or wiring to the Building or Premises.

6.1.3 Landlord shall provide city water from the regular Building outlets for drinking, lavatory and toilet purposes.

6.1.4 Landlord shall provide janitorial services five (5) days per week, except the date of observation of the Holidays, in and about the Premises and window washing services in a manner consistent with other comparable buildings in the vicinity of the Project

6.1.5 Landlord shall provide nonexclusive, non-attended automatic passenger elevator service during the Building Hours, shall have one elevator available at all other times, except on the Holidays.

6.2 Electricity; Janitorial Service; Above Standard Tenant Services.

6.2.1 Electricity. Notwithstanding anything to the contrary set forth in Section 4 or this Article 6, Tenant shall directly pay for all electricity attributable to its use of the entire Premises (i.e., subject to any equitable adjustments for any over-standard use more particularly identified in Section 6.3, below, Tenant's Share of the cost of electricity for the Building). Tenant's payment of such amounts shall be made (i) concurrently with its monthly payment of Base Rent to the extent Landlord has previously delivered a "monthly estimate" notification, or (ii) within ten (10) days after demand (inclusive of any reconciliation statements), in either event as Additional Rent under this Lease. Given Tenant's direct payment obligations set forth hereinabove, the cost of electricity for the Building shall be excluded from Operating Expenses.

6.2.2 Above-Standard Tenant Services. Notwithstanding anything to the contrary set forth in Section 4 or this Article 6, Tenant shall directly pay to Landlord one hundred percent (100%) of the cost of all services required by Tenant to be provided by Landlord which are in excess of the services set forth in Section 6.1, above (collectively, the "Above-Standard Tenant Service"), including, but not limited to, (i) twenty-four (24) hour security services, (ii) twenty-four (24) hour porter service, (iii) any over-standard use more particularly identified in Section 6.3, below.

6.3 Overstandard Tenant Use. Tenant shall not, without Landlord's prior written consent, use heat- generating machines, machines other than normal fractional horsepower office machines, or equipment or lighting other than Building standard lights in the Premises, which may affect the temperature otherwise maintained by the air conditioning system or increase the water normally furnished for the Premises by Landlord pursuant to the terms of Section 6.1 of this Lease. If such consent is given, Landlord shall have the right to install supplementary air conditioning units or other facilities in the Premises, including supplementary or additional metering devices, and the cost thereof, including the cost of installation, operation and maintenance, increased wear and tear on existing equipment and other similar charges, shall be paid by Tenant to Landlord upon billing by Landlord. If Tenant uses water, electricity, heat or air conditioning in excess of that supplied by Landlord pursuant to Section 6.1 of this Lease, Tenant shall pay to Landlord, upon billing, the cost of such excess consumption, the cost of the installation, operation, and maintenance of equipment which is installed in order to supply such excess consumption, and the cost of the increased wear and tear on existing equipment caused by such excess consumption; and Landlord may install devices to separately meter any increased use and in such event Tenant shall pay the increased cost directly to Landlord, on demand, at the rates charged by the public utility company furnishing the same, including the cost of such additional metering devices. Tenant's use of electricity shall never exceed the capacity of the feeders to the Project or the risers or wiring installation. Tenant shall not install or use or permit the installation or use of any computer or electronic data processing equipment in the Premises, without the prior written consent of Landlord. If Tenant desires to use heat, ventilation or air conditioning during hours other than those for which Landlord is obligated to supply such utilities pursuant to the terms of Section 6.1 of this Lease, Tenant shall give Landlord such prior notice, if any, as Landlord shall from time to time establish as appropriate, of Tenant's desired use in order to supply such utilities, and Landlord shall supply such utilities to Tenant at such hourly cost to Tenant (which shall be treated as Additional Rent) as Landlord shall from time to time establish.

6.4 Interruption of Use. Except as otherwise expressly provided in this Lease, Tenant agrees that Landlord shall not be liable for damages, by abatement of Rent or otherwise, for Tenant's failure to obtain, or for any failure to furnish or delay in furnishing, any service (including telephone and telecommunication services), or for any diminution in the quality or quantity thereof, when such failure or delay or diminution is occasioned, in whole or in part, by repairs, replacements, or improvements, by any strike, lockout or other labor trouble, by inability to secure electricity, gas, water, or other fuel at the Building after reasonable effort to do so, by any accident or casualty whatsoever, by act or default of Tenant or other parties, or by any other cause; and such failures or delays or diminution shall never be deemed to constitute an eviction or disturbance of Tenant's use and possession of the Premises or relieve Tenant from paying Rent or performing any of its obligations under this Lease, except as otherwise expressly provided in this Lease. Furthermore, Landlord shall not be liable under any circumstances for a loss of, or injury to, property or for injury to, or interference with, Tenant's business, including, without limitation, loss of profits, however occurring, through or in connection with or incidental to Tenant's failure to obtain, or for any failure to furnish any of the services or utilities as set forth in this Article 6. Rent Abatement. If (i) Landlord fails to perform the obligations required of Landlord under the TCCs of this Lease, (ii) such failure causes all or a portion of the Premises to be untenantable and unusable by Tenant, and (iii) such failure relates to (A) the nonfunctioning of the heat, ventilation, and air conditioning system in the Premises, the electricity in the Premises, the nonfunctioning of the elevator service to the Premises, or (B) a failure to provide access to the Premises, Tenant shall give Landlord notice (the "Initial Notice"), specifying such failure to perform by Landlord (the "Landlord Default"). If Landlord has not cured such Landlord Default within five (5) business days after the receipt of the Initial Notice (the "Eligibility Period"), Tenant may deliver an additional notice to Landlord (the "Additional Notice"), specifying such Landlord Default and Tenant's intention to abate the payment of Rent under this Lease. If Landlord does not cure such Landlord Default within five (5) business days of receipt of the Additional Notice, Tenant may, upon written notice to Landlord, immediately abate Rent payable under this Lease for that portion of the Premises rendered untenantable and not used by Tenant, for the period beginning on the date five (5) business days after the Initial Notice to the earlier of the date Landlord cures such Landlord Default or the date Tenant recommences the use of such portion of the Premises. Such right to abate Rent shall be Tenant's sole and exclusive remedy at law or in equity for a Landlord Default. Except as provided in this Section 6.4, nothing contained herein shall be interpreted to mean that Tenant is excused from paying Rent due hereunder.

ARTICLE 7

REPAIRS

Tenant shall, at Tenant's own expense, keep the Premises, including all improvements, fixtures, equipment, window coverings, and furnishings therein, in good order, repair and condition at all times during the Lease Term. In addition, Tenant shall, at Tenant's own expense but under the supervision and subject to the prior approval of Landlord, and within any reasonable period of time specified by Landlord, promptly and adequately repair all damage to the Premises and replace or repair all damaged or broken fixtures and appurtenances; provided however, that, at Landlord's option, or if Tenant fails to make such repairs, Landlord may, but need not, make such repairs and replacements, and Tenant shall pay Landlord the cost thereof, including a percentage of the cost thereof (to be uniformly established for the Building) sufficient to reimburse Landlord for all overhead, general conditions, fees and other costs or expenses arising from Landlord's involvement with such repairs and replacements forthwith upon being billed for same. Notwithstanding the foregoing, Landlord shall be responsible for repairs to the exterior walls, foundation and roof of the Building, the structural portions of the floors of the Building, and the systems and equipment of the Building (collectively, the "Base Building"), except to the extent that such repairs are required due to the negligence or willful misconduct of Tenant; provided, however, that if such repairs are due to the negligence or willful misconduct of Tenant, Landlord shall nevertheless make such repairs at Tenant's expense, or, if covered by Landlord's insurance, Tenant shall only be obligated to pay any deductible in connection therewith. Landlord may, but shall not be required to, enter the Premises at all reasonable times to make such repairs, alterations, improvements and additions to the Premises or to the Building or to any equipment located in the Building as Landlord shall desire or deem necessary or as Landlord may be required to do by governmental or quasi-governmental authority or court order or decree; provided, however, except for (i) emergencies, (ii) repairs, alterations, improvements or additions required by governmental or quasi-governmental authorities or court order or decree, or (iii) repairs which are the obligation of Tenant hereunder, any such entry into the Premises by Landlord shall be performed in a manner so as not to materially interfere with Tenant's use of, or access to, the Premises; provided that, with respect to items (ii) and (iii) above, Landlord shall use commercially reasonable efforts to not materially interfere with Tenant's use of, or access to, the Premises.

ARTICLE 8

ADDITIONS AND ALTERATIONS

Tenant may not make any improvements, alterations, additions or changes to the Premises during the Lease Term without the consent of Landlord, which consent may be granted, withheld or conditioned in the sole and absolute discretion of Landlord. Landlord and Tenant hereby acknowledge and agree that (i) all Alterations, improvements, fixtures, equipment and/or appurtenances which may be installed or placed in or about the Premises, from time to time, shall be at the sole cost of Tenant and shall be and become the property of Landlord, and (ii) the Tenant Improvements to be constructed in the Premises pursuant to the TCCs of the Tenant Work Letter shall, upon completion of the same, be and become a part of the Premises and the property of Landlord; provided, however, that notwithstanding the foregoing, Tenant may remove any Alterations, improvements, fixtures and/or equipment which Tenant can substantiate to Landlord have not been paid for with any Tenant improvement allowance funds provided to Tenant by Landlord, provided Tenant repairs any damage to the Premises and Building caused by such removal and returns the affected portion of the Premises to a building standard tenant improved condition as determined by Landlord.

ARTICLE 9

COVENANT AGAINST LIENS

Tenant has no authority or power to cause or permit any lien or encumbrance of any kind whatsoever, whether created by act of Tenant, operation of law or otherwise, to attach to or be placed upon the Building or Premises, and any and all liens and encumbrances created by Tenant shall attach to Tenant's interest only. Tenant covenants and agrees not to suffer or permit any lien of mechanics or materialmen or others to be placed against the Building or the Premises with respect to work or services claimed to have been performed for or materials claimed to have been furnished to Tenant or the Premises, and, in case of any such lien attaching or notice of any lien, Tenant covenants and agrees to cause it to be immediately released and removed of record. Notwithstanding anything to the contrary set forth in this Lease, in the event that such lien is not released and removed on or before the date notice of such lien is delivered by Landlord to Tenant, Landlord, at its sole option, may immediately take all action necessary to release and remove such lien, without any duty to investigate the validity thereof, and all sums, costs and expenses, including reasonable attorneys' fees and costs, incurred by Landlord in connection with such lien shall be deemed Additional Rent under this Lease and shall immediately be due and payable by Tenant.

ARTICLE 10

INSURANCE

10,1 Indemnification and Waiver. To the extent not prohibited by law, Landlord, its members, partners and their respective officers, agents, servants, employees, and independent contractors (collectively, "Landlord Parties") shall not be liable for any damage either to person or property or resulting from the loss of use thereof, which damage is sustained by Tenant or by other persons claiming through Tenant. Tenant shall indemnify, defend, protect, and hold harmless Landlord Parties from any and all loss, cost, damage, expense and liability (including without limitation court costs and reasonable attorneys' fees) incurred in connection with or arising from (i) any cause in, on or about the Premises, and (ii) any acts, omissions or negligence of Tenant or of any person claiming by, through or under Tenant, its partners, and their respective officers, agents, servants, employees, and independent contractors (collectively, the "Tenant Parties"), in, on or about the Project, in either event either prior to, during, or after the expiration of the Lease Term, provided that the terms of the foregoing indemnity shall not apply to the gross negligence or willful misconduct of Landlord. The provisions of this Section 10.1 shall survive the expiration or sooner termination of this Lease with respect to any claims or liability occurring prior to such expiration or termination. Notwithstanding anything to the contrary contained in this Lease, nothing in this Lease shall impose any obligations on Tenant or Landlord to be responsible or liable for, and each hereby releases the other from all liability for, consequential damages other than those consequential damages incurred by Landlord in connection with a holdover of the Premises by Tenant after the expiration or earlier termination of this Lease or incurred by Landlord in connection with any repair, physical construction or improvement work performed by or on behalf of Tenant in the Project, but Tenant shall not be responsible for any direct or consequential damages resulting from Landlord's or contractor's acts in connection with the completion by Landlord of the tenant improvements in the Premises pursuant to the Tenant Work Letter.

10.2 Tenant's Compliance with Landlord's Fire and Casualty Insurance. Tenant shall, at Tenant's expense, comply as to the Premises with all insurance company requirements pertaining to the use of the Premises. If Tenant's conduct or use of the Premises causes any increase in the premium for such insurance policies, then Tenant shall reimburse Landlord for any such increase. Tenant, at Tenant's expense, shall comply with all rules, orders, regulations or requirements of the American Insurance Association (formerly the National Board of Fire Underwriters) and with any similar body.

10.3 Tenant's Insurance. Tenant shall maintain Commercial/Comprehensive General Liability Insurance covering the insured against claims of bodily injury, personal injury and property damage (including loss of use thereof) arising out of Tenant's operations, and contractual liabilities (covering the performance by Tenant of its indemnity agreements) including a Broad Form endorsement covering the insuring provisions of this Lease and the performance by Tenant of the indemnity agreements set forth in Section 10.1 of this Lease, for limits of liability not less than $1,000,000.00 for each occurrence and $2,000,000.00 annual aggregate, with 0% Insured's participation. In addition, Tenant shall carry Property Insurance covering all office furniture, trade fixtures, office equipment, merchandise and all other items of Tenant's property on the Premises installed by, for, or at the expense of Tenant. Such insurance shall be written on an "all risks" of physical loss or damage basis, for the full replacement cost value new without deduction for depreciation of the covered items and in amounts that meet any co-insurance clauses of the policies of insurance and shall include a vandalism and malicious mischief endorsement, sprinkler leakage coverage and earthquake sprinkler leakage coverage. Furthermore, Tenant shall maintain (A) Worker's Compensation or other similar insurance pursuant to all applicable state and local statutes and regulations, and Employer's Liability Insurance or other similar insurance pursuant to all applicable state and local statutes and regulations, with a waiver of subrogation endorsement and with minimum limits of One Million and No/100 Dollars ($1,000,000.00) per employee and One Million and No/100 Dollars ($1,000,000.00) per occurrence, and (B) Comprehensive Automobile Liability Insurance covering all owned, hired, or non-owned vehicles with the following limits of liability: One Million Dollars ($1,000,000.00) combined single limit for bodily injury and property damage.